Recommended articles:

-

-

Global Energy Interconnection

Volume 8, Issue 4, Aug 2025, Pages 685-699

Peer-to-peer transaction with voltage management strategy in distribution network considering trading risk☆

Abstract

Abstract

0 Introduction

The increasing penetration of distributed energy resources(DERs)is driving a new paradigm in power system operation and electricity market transactions,particularly accelerating the emergence of peer-to-peer (P2P)market [1,2].In this context, prosumers with both generation and consumption capabilities can participate as independent economic agents in energy trading and sharing, effectively balancing supply and demand while enhancing energy efficiency [3].However, the privacy and autonomy requirements among prosumers are gradually driving the market toward decentralization.In a liberalized market, profit-driven behavior among prosumers may lead to post-trading risks such as voltage violations,posing significant challenges to network security [4,5].Therefore, exploring novel approaches to integrate and leverage the flexibility of local power system while achieving a balance between prosumers’ economic interests and distribution network security has become an urgent issue that needs to be addressed.

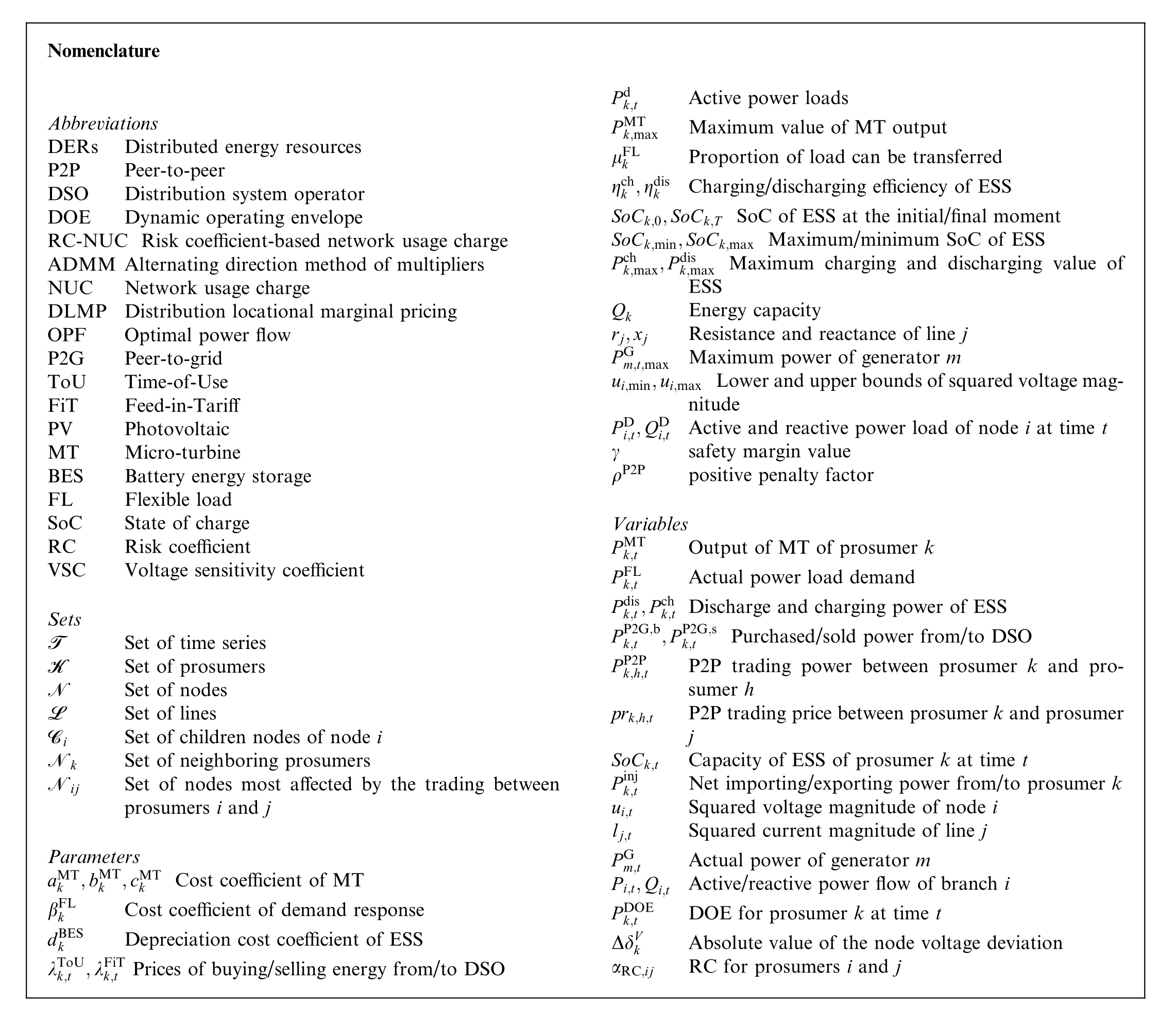

Nomenclature Abbreviations DERs Distributed energy resources P2P Peer-to-peer DSO Distribution system operator DOE Dynamic operating envelope RC-NUC Risk coefficient-based network usage charge ADMM Alternating direction method of multipliers NUC Network usage charge DLMP Distribution locational marginal pricing OPF Optimal power flow P2G Peer-to-grid ToU Time-of-Use FiT Feed-in-TariffPV Photovoltaic MT Micro-turbine BES Battery energy storage FL Flexible load SoC State of charge RC Risk coefficient VSC Voltage sensitivity coefficient TSets Set of time series K Set of prosumers N Set of nodes L Set of lines Ci i Set of children nodes of node Nk Set of neighboring prosumers Nij Set of nodes most affected by the trading between prosumers i and j Parameters aMk T bMT k cMTk Cost coefficient of MT βFL k Cost coefficient of demand response S Depreciation cost coefficient of ESS λTo dBE k k tU λFiTk t Prices of buying/selling energy from/to DSO Pdk t Active power loads PMkTmax Maximum value of MT output μFL k Proportion of load can be transferred ηch k ηdisk Charging/discharging efficiency of ESS SoCk 0 SoCk T SoC of ESS at the initial/final moment SoCk min SoCk max Maximum/minimum SoC of ESS Pch k max Pdisk max Maximum charging and discharging value of ESS Qk Energy capacity rj xj Resistance and reactance of line j PGm t max Maximum power of generator m ui min ui max Lower and upper bounds of squared voltage magnitude PDi t QDi t Active and reactive power load of node i at time t γ safety margin value ρP2P positive penalty factor Variables PMk tT Output of MT of prosumer k PFk tL Actual power load demand k t Pchk t Discharge and charging power of ESS PP2 Pdis k tGb PP2Gs k t Purchased/sold power from/to DSO PP2 kPh t P2P trading power between prosumer k and prosumer h prk h t P2P trading price between prosumer k and prosumer j SoCk t Capacity of ESS of prosumer k at time t Pk t inj Net importing/exporting power from/to prosumer k ui t Squared voltage magnitude of node i lj t Squared current magnitude of line j PGm t Actual power of generator m Pi t Qi t Active/reactive power flow of branch i PDk tOE DOE for prosumer k at time t Δδk V Absolute value of the node voltage deviation αRC ij RC for prosumers i and j

After prosumers negotiate the P2P trading quantities and prices, energy delivery must be carried out through distribution network lines.Therefore,they must adhere to physical constraints to ensure the feasibility of energy transactions.To improve network security, numerous studies have introduced the distribution system operator(DSO) in the P2P trading market to supervise and guide prosumers.For instance, the impact of short-term P2P transactions on node voltage and line flow is analyzed using sensitivity methods [6].Prosumers identified as posing a threat to network security are restricted from trading.Meanwhile, various techniques have been employed to optimize power flow and coordinate P2P trading to meet network constraints, such as network reconfiguration[7,8,11], on-load tap changers [9], reactive power management [10,11] and ancillary services [12].These approaches primarily focus on direct power control, requiring the DSO to obtain detailed P2P trading information from prosumers for centralized security verification.However,they lack incentive mechanisms to encourage prosumers to engage in grid-friendly trading.These methods lack sufficient motivation for prosumers to autonomously align their interests with the overall grid stability,which is a critical gap in current literature.

To this end, some researchers have proposed indirect power adjustment methods based on price signals.The network usage charge (NUC) based on electrical distance was proposed to shift the responsibility of mitigating system risks into a self-incentive mechanism by imposing additional transaction costs on prosumers [13].However,this strategy fails to fully account for the influence of power flow distribution.In contrast, the above problem can be effectively addressed by calculating the distribution locational marginal pricing (DLMP) based on network operating conditions and the optimal power flow (OPF)solution.Reference [14] utilizes DLMP to incentivize P2P transactions that contribute to network security and punish those that compromise it.In [15], NUC is calculated based on DLMP differences, indirectly influencing prosumers’decision-making and guiding their transactions to meet network constraints.In summary, the method based on price signal guidance ensures network security while effectively reducing the risk of system operation without disclosing prosumers’ transaction privacy.This approach provides strong theoretical support for system risk control in a P2P trading environment.However, this approach has certain limitations in practical applications.When P2P trading leads to an infeasible OPF solution,the DSO is unable to extract Lagrange multipliers to calculate DLMP and NUC, which reduces the applicability of this method.Some studies have adopted a gradually shrinking feasible domain approach to ensure OPF feasibility[10],but the selection of step size is highly subjective and can affect the optimality of the results.

To address the above challenges, some scholars have introduced the dynamic operating envelope (DOE) into the electricity market to ensure that prosumers trade within a secure operational domain.Unlike traditional fixed import and export restrictions [16,17], DOE serves as a dynamic limit that allocates optimal import and export power envelopes over time for prosumers at different nodes[18].This approach not only enhances network security but also accounts for economic interests of prosumers.However, most existing studies have primarily applied DOEbased coordination framework to peer-to-grid(P2G)transactions [20,21], with limited studies exploring its application to P2P transactions.Since P2P trading involves numerous direct trading between prosumers,making management and coordination more challenging.When incorporating the DOE method, it is also essential to establish an effective information sharing framework to ensure transparency and fairness.Furthermore, under the DOE method, node voltages only need to remain within rated boundaries to ensure security.However, fluctuations in generation and load, coupled with market uncertainties,can introduce volatility into P2P transaction outcomes,potentially causing market imbalances and threatening power system stability[22,23].Various uncertainty factors may cause voltage deviations beyond the predetermined safety range,endangering system stability.To mitigate this potential risk, the system must remain a certain security margin to deal with these disturbances.

Existing studies have explored price-guided method to further enhance the security margin [14,15,24].Based on this, the DOE can be utilized to provide a secure and feasible operating region, ensuring solvability in DLMP calculations.It is important to note that when the network operates near its security boundary, the voltage component of DLMP approaches zero.This implies that DLMP fails to effectively reflect the network actual operating state,weakening the guidance effect of price signals.Therefore,to comprehensively account for the impact of various uncertainties on network security, it is necessary to conduct risk assessments based on the network operating conditions and explore new electricity pricing mechanisms.By optimizing the intensity of price signals, the system can more flexibly mitigate potential constraint violations,thereby enhancing overall network security.

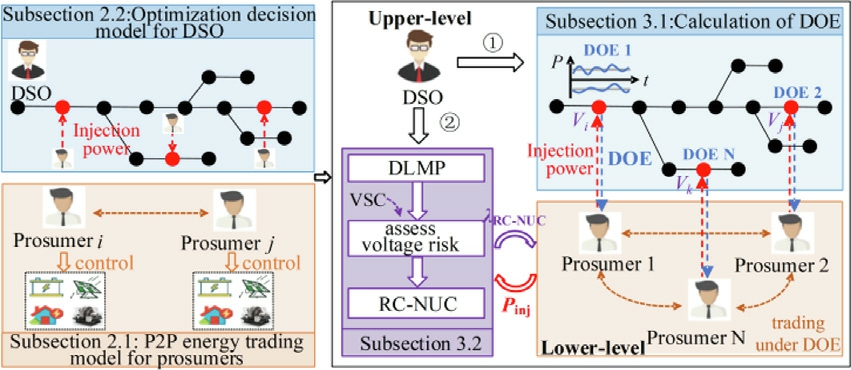

This paper presents a novel DSO-prosumers bi-level coordination framework incorporating the DOE and risk coefficient-based network usage charge (RC-NUC) to tackle network security issues.To ensure feasible OPF,prosumers are first allowed to conduct P2P trading within the DOE.Subsequently, the RC-NUC is introduced to further guide prosumers towards grid-friendly transactions, improving the reliability of managing network risks in P2P trading.The main contributions are as follows:

1)A DSO-prosumers bi-level coordination framework is proposed to balance network security and prosumers’ economic interests.The upper-level employs DOE and RC-NUC models to ensure security,while the lower-level features a decentralized P2P market to protect prosumers’ privacy.In this framework,the DSO guides prosumer transactions using the DOE and RC-NUC with a focus on security, while prosumers maximize their individual economic benefits.Only price and power information are exchanged, preserving multi-party privacy.

2)A risk coefficient-based network usage charge (RCNUC) method is proposed, accounting for the impact of decentralized P2P transactions on distribution network power flow.This pricing signal effectively reflects the severity of voltage risks caused by each transaction, providing more precise guidance for prosumers to adjust their trading quantities and enhancing the reliability of network risk management in P2P trading scenarios.

3)A DOE computation method tailored for P2P trading is proposed, enabling dynamic adjustment of optimal import and export power.Prosumers can freely determine trading quantities and price within the DOE constraints, ensuring feasible power flow at the upper-level.The lower-level P2P trading problem is solved by ADMM with adaptive penalty factor algorithm, which accelerates convergence by dynamically adjusting parameters.This allows each prosumer to independently optimize decisions with limited information sharing while preserving transaction privacy and autonomy.

The rest of this paper is summarized as follows.Section 1 introduces the mathematical model of prosumers and DSO.The proposed bi-level coordination framework and solution algorithm are introduced in Section 2.Also,we elaborate the DOE and RC-NUC calculation method in it.Numerical simulation studies are performed in Section 3.Section 4 concludes.

1 Mathematical models of prosumers and DSO

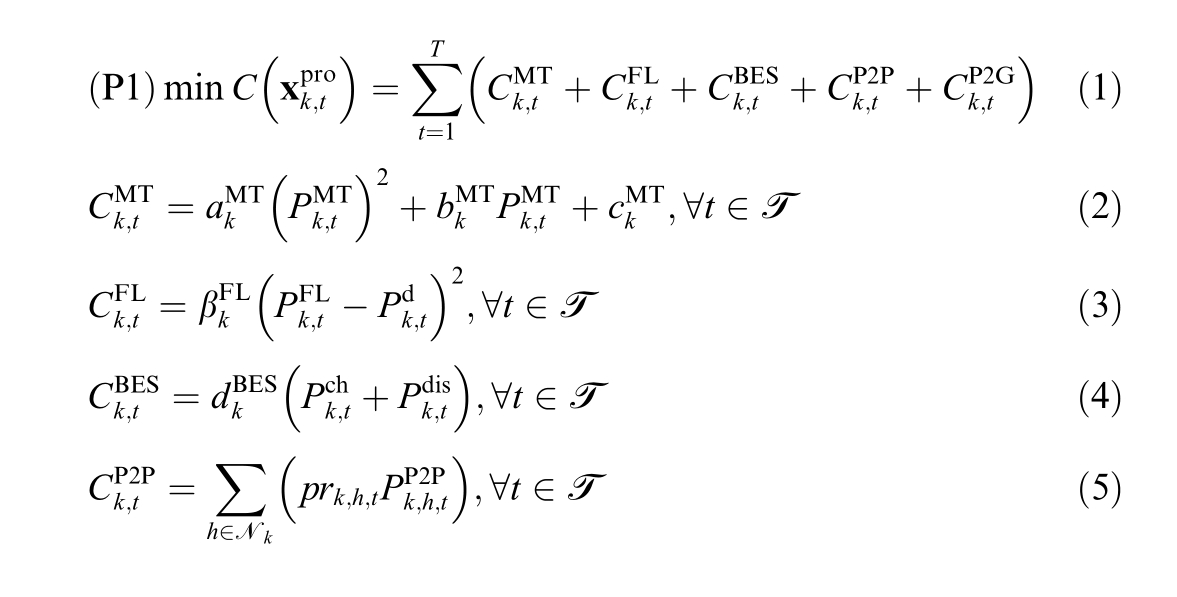

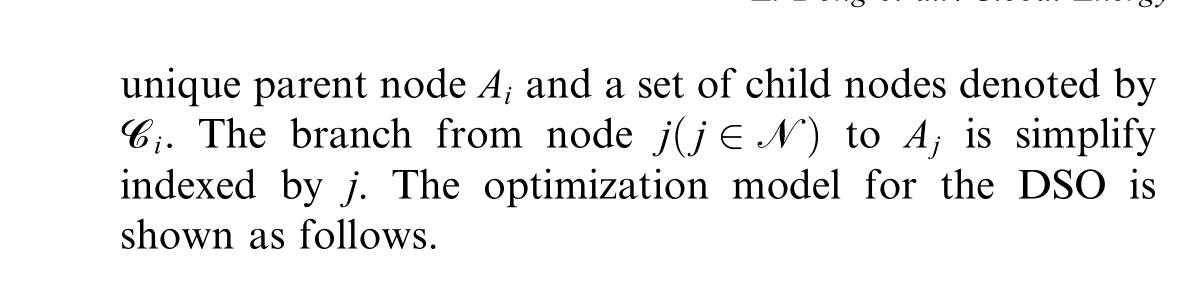

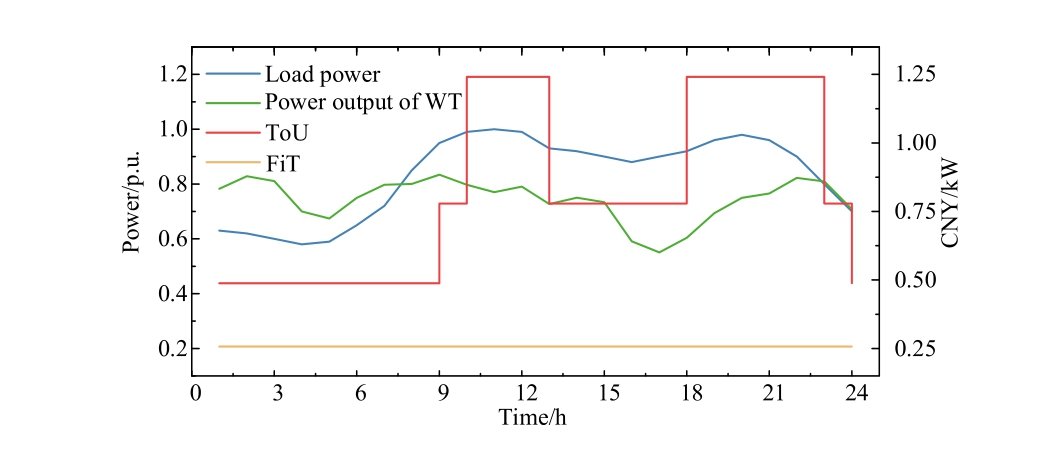

The relationship between prosumers and DSO is shown in Fig.1.Prosumers connected to the distribution network are configured with DERs, and their goal is to maximize their individual benefits.They can engage in P2P trading based on their energy requirements and preferences or they can purchase and sell energy to the DSO using Time-of-Use(ToU)and Feed-in-Tariff(FiT)schemes.These transactions are entirely independent decisions made by prosumers, with no direct influence from the DSO.The DSO, acting as the market operator, receives net power injection from prosumers.Its objective is to minimize operational costs while maintaining the network security.The mathematical models for both the prosumers and the DSO are provided here.

1.1 P2P energy trading model for prosumers

This paper assumes that each prosumer is equipped with flexible resources, including photovoltaic (PV),micro-turbine (MT), battery energy storage (BES), and flexible load (FL).For a given prosumer![]() the optimal power scheduling model with P2P energy trading is formulated as follows.

the optimal power scheduling model with P2P energy trading is formulated as follows.

1) Objective function

Fig.1.P2P energy trading market in the distribution network.

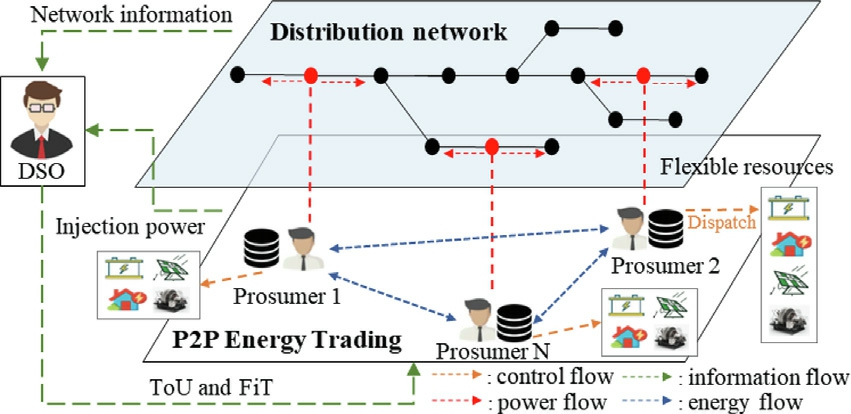

where![]() are the decision variables set for prosumer k.The total objective function (1) consists of the MT generation cost, discomfort cost, BES degradation cost, P2P trading cost and P2G trading cost.The specific formulations of each cost function are stated as (2)-(6).

are the decision variables set for prosumer k.The total objective function (1) consists of the MT generation cost, discomfort cost, BES degradation cost, P2P trading cost and P2G trading cost.The specific formulations of each cost function are stated as (2)-(6).

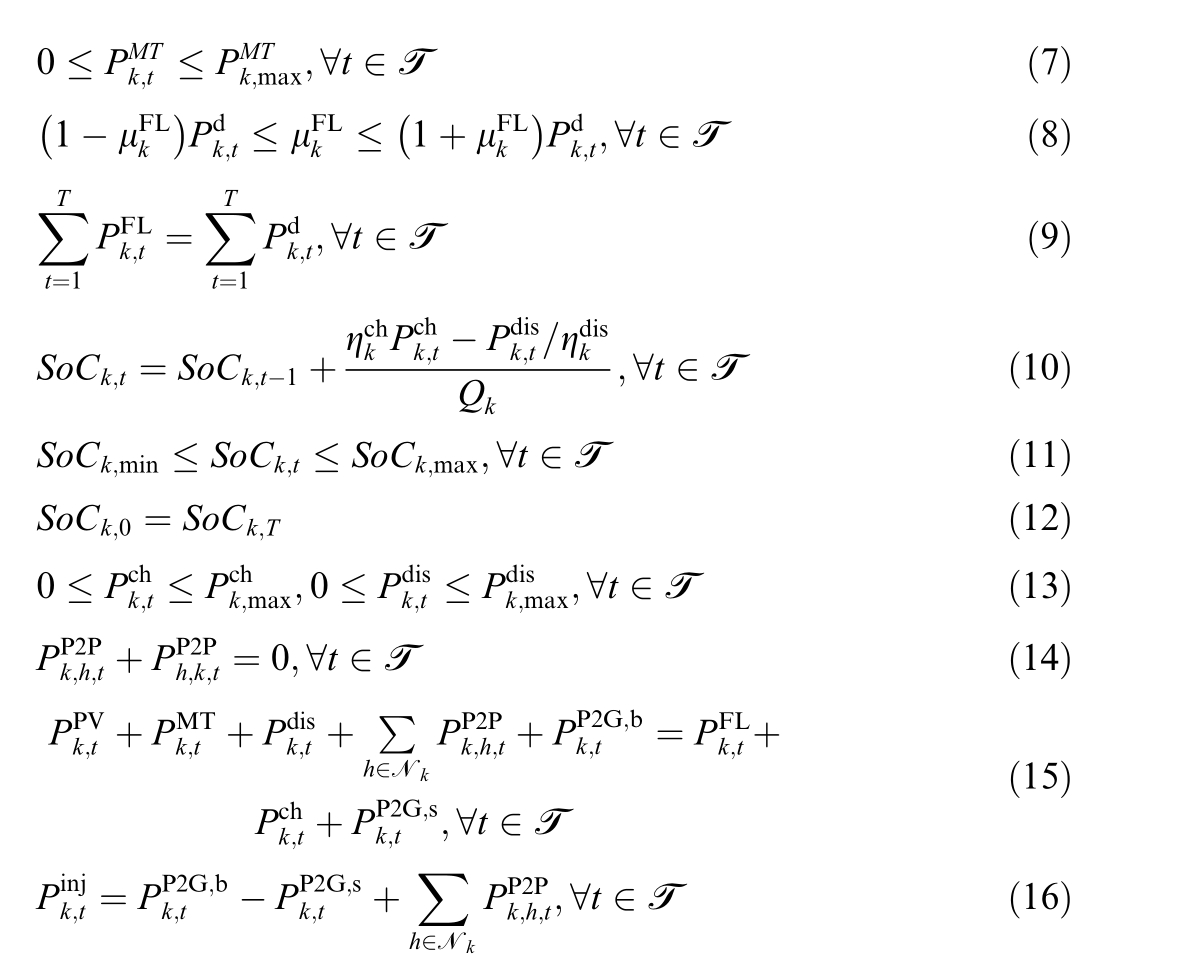

2) Operation constraints

Specifically, constraint (7) presents the power output limits of MT.Constraint (8) sets bound for the actual FL power.Constraint(9)gives the relationship between actual and expected energy demand.For the BES,constraint(10)relates the measured SoC to the charging and discharging power.Constraints (11) and (12) imply the restriction and initial/final condition of the SoC,respectively.Constraints(13)limits the charging and discharging power.Constraint(14)indicates that the energy exchanged between two prosumers is equal in magnitude but opposite in polarity.Constraints (15) and (16) represent the active power balance and the net power injection equation, respectively.

Solve the above model P1 to determine P2P trading power and pricing.The DSO collects net power injection data from prosumers and performs OPF to minimize operating costs while ensuring that the distribution system operates within its constraints.

1.2 Optimization decision model for DSO

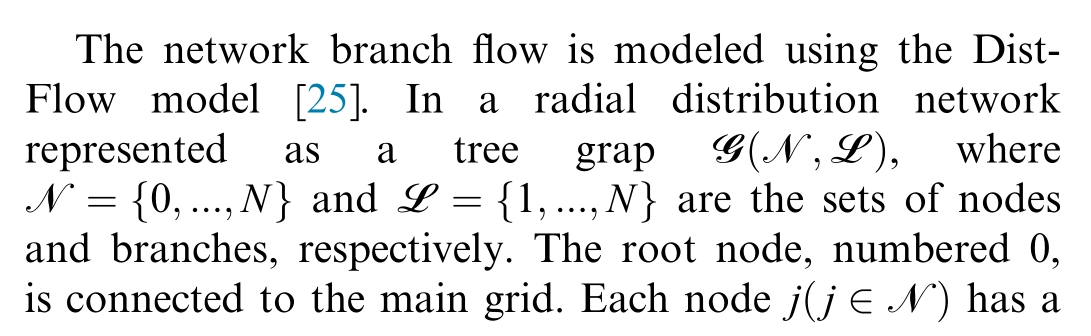

1) Objective function

where![]() is LMP of wholesale market.

is LMP of wholesale market.![]() is active power injection at the root node.The objective function(17) aims to minimize the total cost.The cost of purchasing power from the wholesale market is represented by the first term, while the revenue from P2G trading is represented by the final two terms.

is active power injection at the root node.The objective function(17) aims to minimize the total cost.The cost of purchasing power from the wholesale market is represented by the first term, while the revenue from P2G trading is represented by the final two terms.

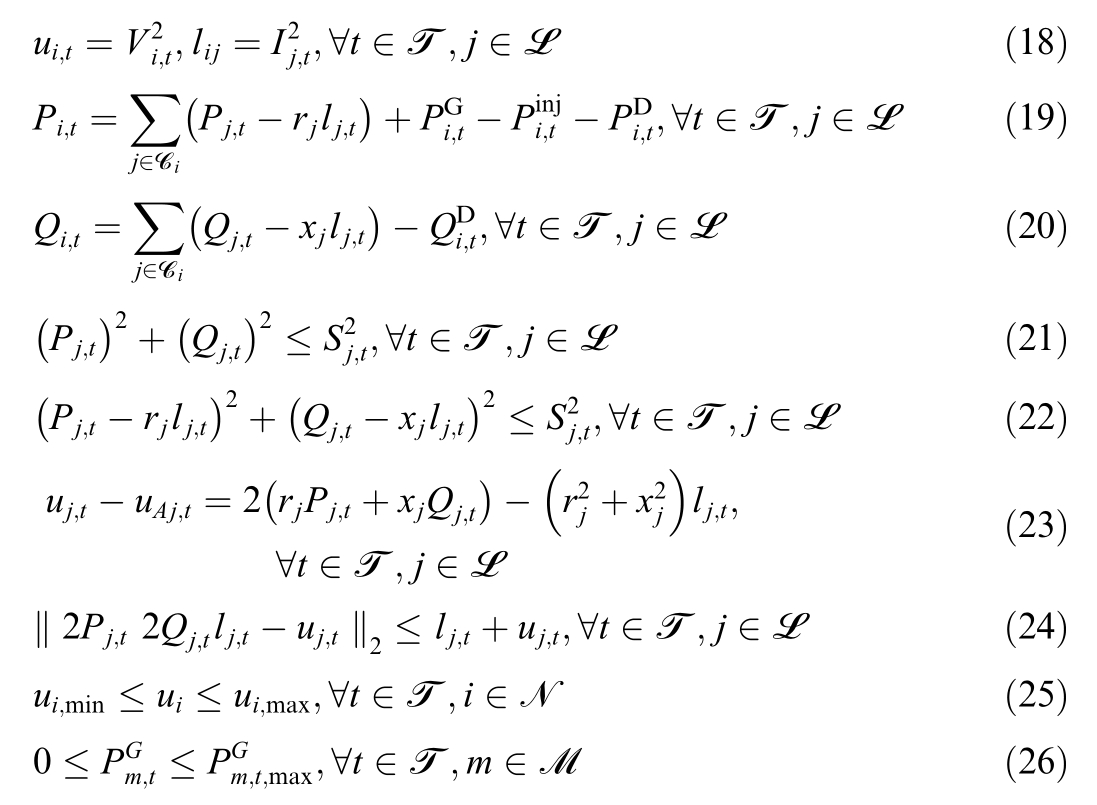

Constraints (19) and (20) represent the active and reactive power balances,respectively.Constraints(21)and(22)define the power flow limits at the receiving and sending nodes of each line.Constraint (23) indicates the voltage drop of the distribution line.The branch current constraint (24) is formulated in a standard second-order cone form[26].Constraint(25)limits nodal voltage magnitudes.The generator constraint is given by (26).

The DSO can only perform OPF calculation based on the net injection power provided by prosumers and cannot directly control P2P trading quantities and price.This limitation may lead to voltage limit violations.Therefore,it is crucial to coordinate the connection between the DSO and prosumers to balance the network security with the privacy and economic interests of prosumers.

2 Coordination framework and solution method based on DOE and RC-NUC guidance

Fig.2.DSO-prosumers bi-level coordination framework.

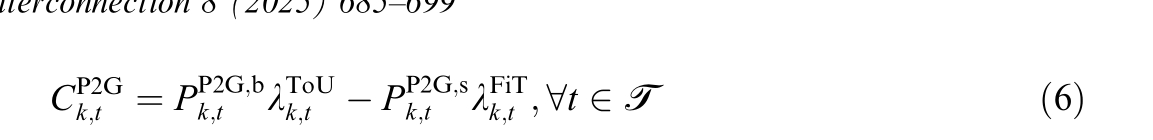

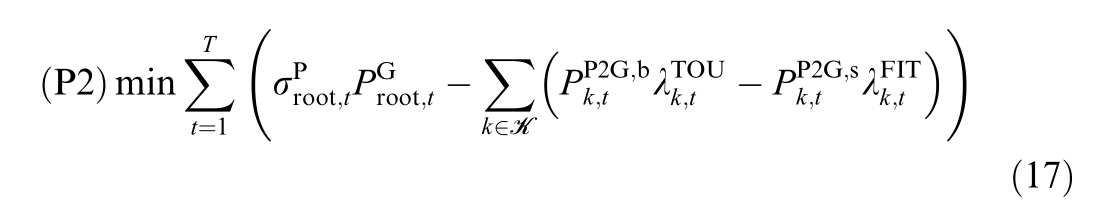

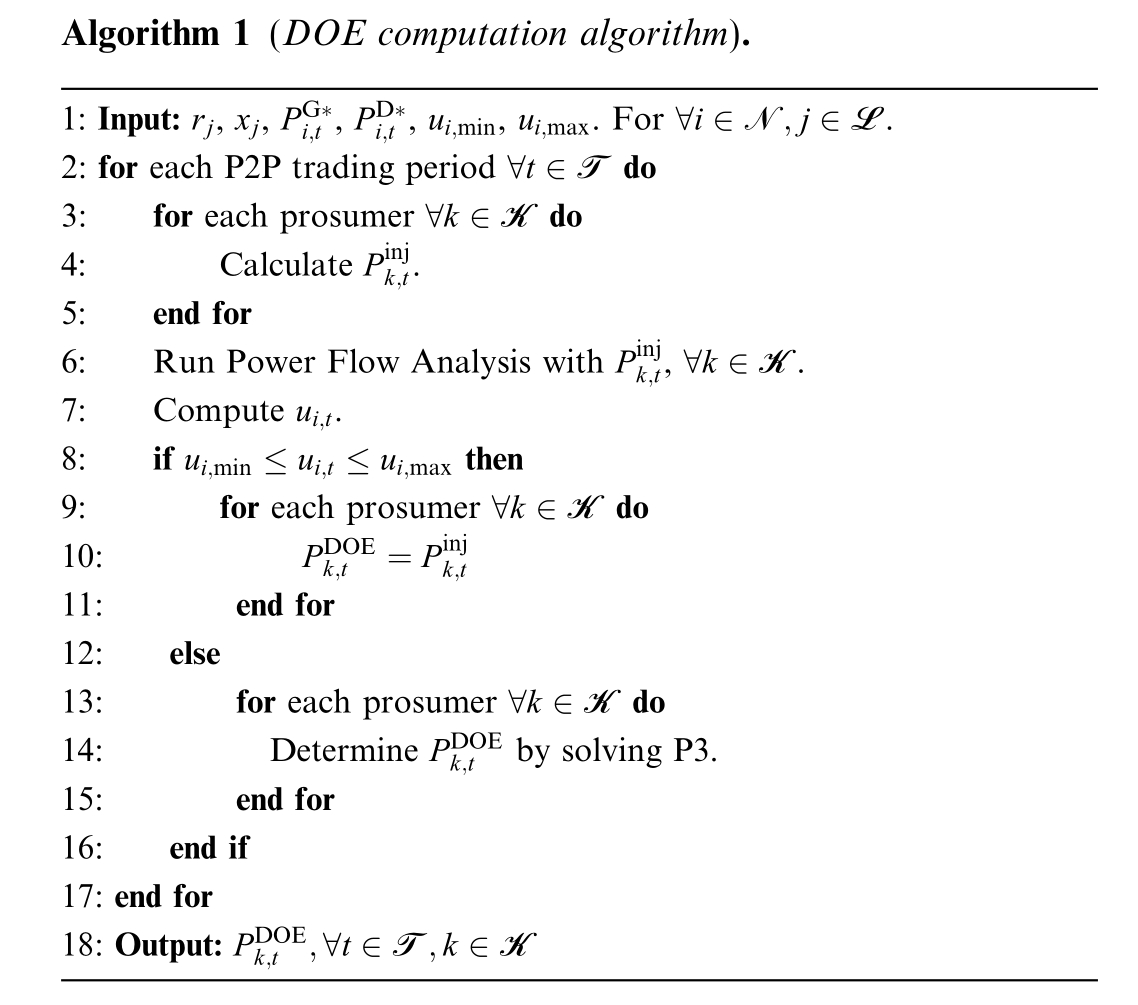

P2P trading may create operational risks to the network, necessitating supervision and guidance from the DSO.The proposed DSO-prosumer bi-level coordination framework is shown in Fig.2.The upper-level comprises a security management model integrating the DOE and RC-NUC, while the lower-level includes a decentralized P2P trading market.To address the risks that P2P trading may impose on the distribution network, the DSO first calculates the DOE,which establishes a specific security boundary for each prosumer’s net power injection.Subsequently, the DSO leverages power flow data to compute the DLMP and RC-NUC, generating price signals that reflect system operational risks.Due to the profit-seeking nature of prosumers,they adapt their decisions in response to the RC-NUC, making the guidance process iterative and continuous.Once the dynamic decision-making process between the DSO and prosumers achieves equilibrium, system risks are mitigated,market participants’ benefits are increased, and network security is maintained within the P2P market environment.

2.1 Calculation of DOE

In the proposed coordination framework, DOE is used to constrain the prosumers’ expected import and export power.The DSO calculates the DOE in two steps.In the initial stage,DSO checks the security of the network based on prosumers’ intended import/export power.If no violations occur, such as voltage constraints, the intended amounts of trading power will be permitted.Otherwise,the DSO computes the DOE in the second step.Decided DOEs result are directly delivered to prosumers,thus they can independently control their assets without any network violation while limiting DSO access to their local information.

To improve trading fairness and avoid excessive curtailment of import or export power for prosumers located farther from the root node, the objective function minimizes the squared distances between the prosumers’intended net power injection![]() and the DO E

and the DO E![]() defined by the DSO, which is shown as follows:

defined by the DSO, which is shown as follows:

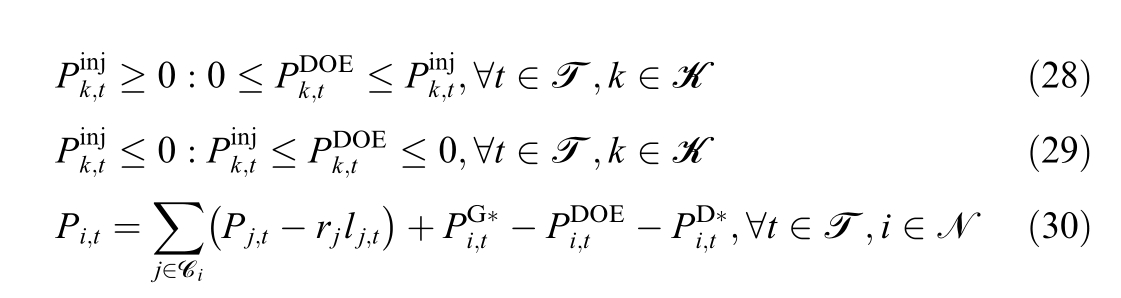

s.t.(18), (20)-(25);

Given that the DSO defines the DOE for prosumers and without the ability to directly control their internal assets and energy trading, certain principles need consideration:(1) If a prosumer plans to import power, they cannot be forced to export or exceed their intended import amount.(2) If a prosumer plans to export power, they cannot be forced to import or exceed their intended export amount.The corresponding constraints are expressed in (28) and(29).Besides, the active power balance constraint of node i based on(19)is reformulated as(30).Where![]() and

and![]() indicate that generation and load at node i remain the same before and after DOE calculation.

indicate that generation and load at node i remain the same before and after DOE calculation.

It’s worth noting that using absolute values could also achieve similar results.However, in such a formulation,prosumers closer to nodes with voltage violations will incur a disproportionate share of power curtailment.This will result in unfair trading, because node voltage is influenced by all prosumers.By minimizing squared distances,the burden of curtailment is distributed more equitably among prosumers, ensuring that each has limits as close as possible to their intended trading quantity.

The detailed steps of the proposed DOE algorithm are presented in Algorithm 1.

Algorithm 1 (DOE computation algorithm).1: Input: rj, xj, PGi t , PDi t , ui min, ui max.For i N j L.2: for each P2P trading period t T do 3: for each prosumer k K do 4: Calculate Pinjk t.5: end for 6: Run Power Flow Analysis with Pinj k t, k K.7: Compute ui t.8: if ui min ui t ui max then 9: for each prosumer k K do 10: PDOE k t Pinjk t 11: end for 12: else 13: for each prosumer k K do 14: Determine PDOEk t by solving P3.15: end for 16: end if 17: end for 18: Output: PDOE k t t T k K

After receiving the DOE from the DSO, prosumers must complete P2P trading within the given net injection power limits.The distribution system can operate within given boundaries, but it is difficult to deal with the harm caused by uncertainty to the system, demanding further guidance.Moreover, transactions conducted under DOE constraints effectively ensure the solvability of the OPF,allowing the DSO to accurately calculate the NUC.

2.2 Definition and model of the RC-NUC method

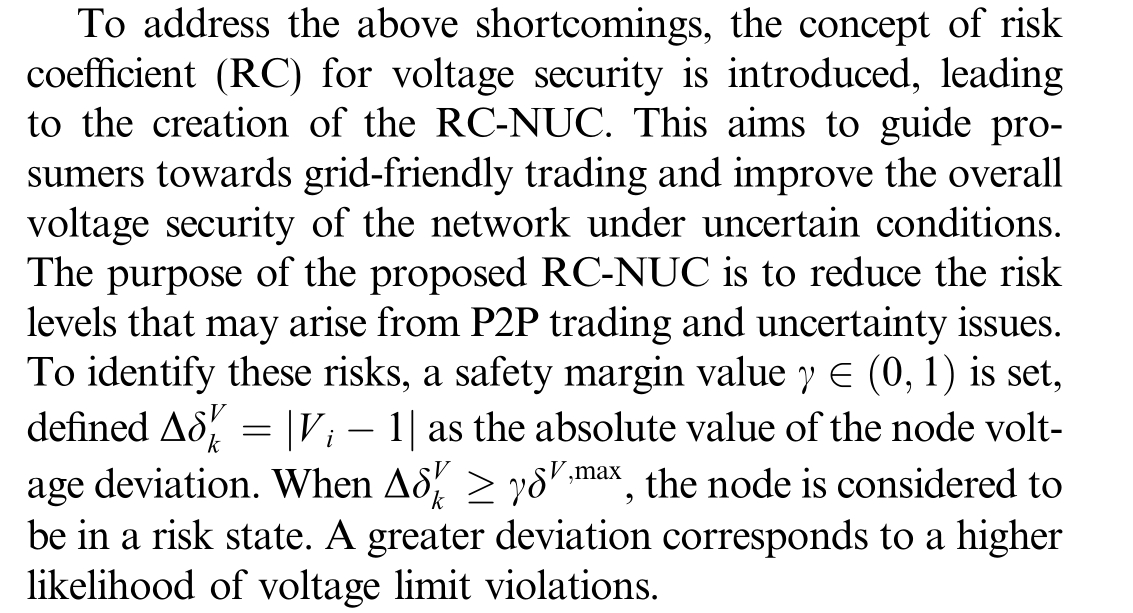

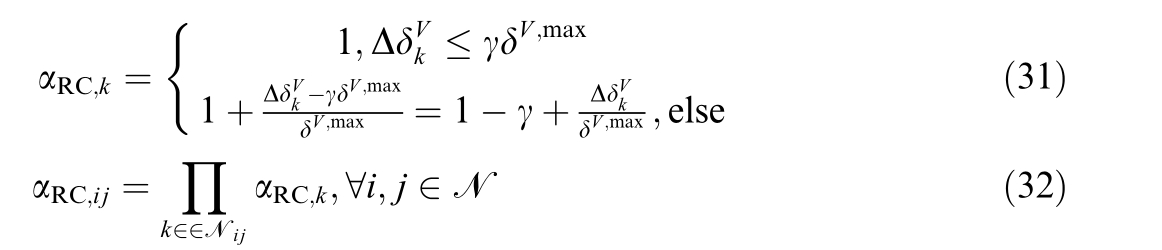

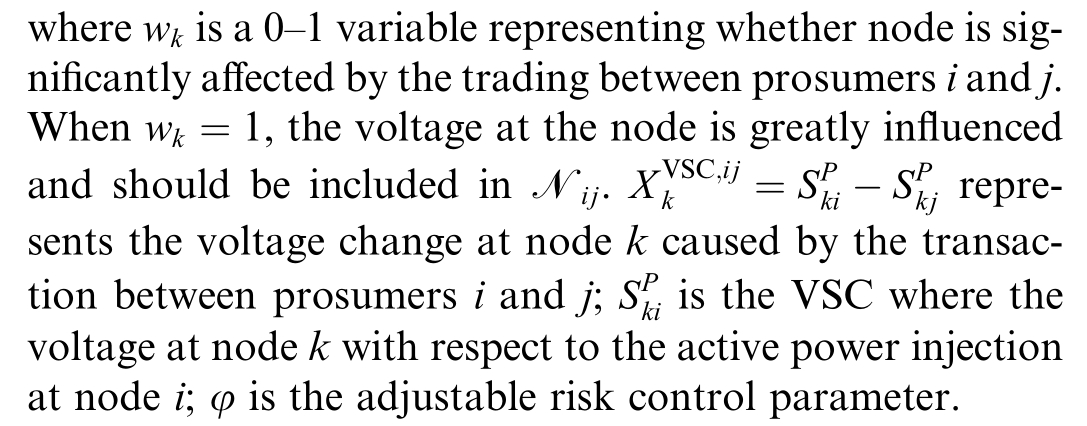

The DLMP fully reflects power flow distribution and demonstrate the impact of regional resources on network security.Its physical model and economic significance are both well interpretable.Moreover, the price components corresponding to each constraint can be obtained by decomposing DLMP,enabling more precise guidance.The NUC is derived from the difference in DLMP between nodes and serves as an effective price signal that influences P2P transactions.This price signal contains information about the risk of voltage limit violations.However, the traditional NUC inadequately reflects voltage constraints, especially when the voltage is close to the safety boundary.Due to the uncertainty of renewable energy output, a previously safe system may suffer voltage limit risks after a disturbance.In such cases,the calculated NUC fails to accurately reflect the current network conditions, making it ineffective in adapting prosumers’trading strategies to alleviate local voltage issues.

The RC fully reflects the risk associated with the impact of any trading on node voltage, and it can be represented by the portion that exceeds the safety margin value.An increase in this value indicates a higher system risk due to trading.Therefore, the RC value should not only positively influence the RC-NUC but also assess the impact of each trade on node voltage.

where αRC ij represents the RC for prosumers i and j; Nij represents the set of nodes most affected by the trading between prosumers i and j.As shown in(31),when a node faces a risk, αRC k is greater than 1.Considering that the voltage sensitivity coefficient (VSC) represents the change in node voltage amplitude caused by power variations at a specific node, it can be used as a basis to describe the impact of trading on the voltage of each node.Therefore,the VSC between two nodes can be calculated as follows:

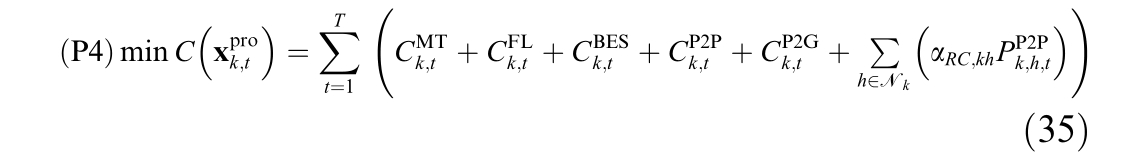

To reflect the impact of regional resources on network security over time and space, and to evaluate the level of voltage risk at different nodes caused by P2P trading, the expression for RC-NUC is defined as:

where λDLMP i is the DLMP of node i, which can be obtained from the dual variables related to problem P2,and the specific analytical expression can be found in[27].

For any P2P trading, prosumer i and j will receive the RC-NUC fairly, implying that there is no price discrimination.The RC can be flexibly updated based on voltage changes.When the voltage approaches the safety boundary,prosumers will face a higher RC-NUC, which encourages them to adjust their trading behavior in response to network conditions.At the same time, the RC will not affect the physical or economic meaning of the original NUC.Therefore, the RC-NUC encourages prosumers to modify their trading behavior to comply with network constraints.

2.3 Solution method for the bi-level framework

Based on the models established in the previous two sections, it is clear that prosumers will participate in the P2P market as much as possible to minimize their costs.The DSO aims to maximize economic benefits while using DOE and RC-NUC to guide prosumers and ensure network security.Therefore, there is a mutual influence between the DSO and prosumers,and they will adjust their decisions in response to each other’s strategies.

Prosumers accept the RC-NUC price signal and must pay an additional risk fee when engaging in P2P trading.Considering that both the buyer and the seller share equal profits from the P2P trading,the risk fee is equally divided between the two parties.Therefore, the objective function and constraints of prosumers are updated as follows:

s.t.(2)-(16);

where![]() represents the DOE limit issued by the DSO.A positive value indicates an import limit,while a negative value indicates an export limit.

represents the DOE limit issued by the DSO.A positive value indicates an import limit,while a negative value indicates an export limit.

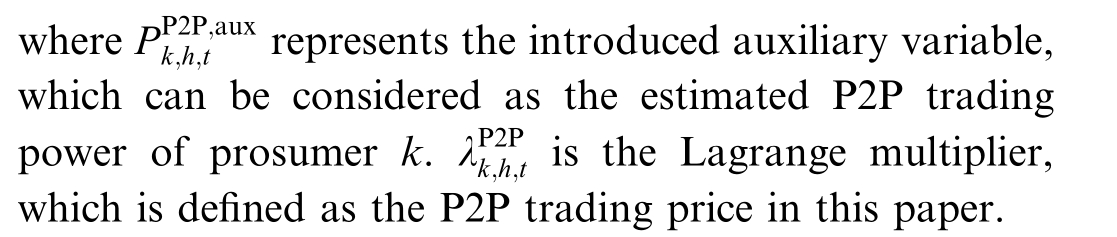

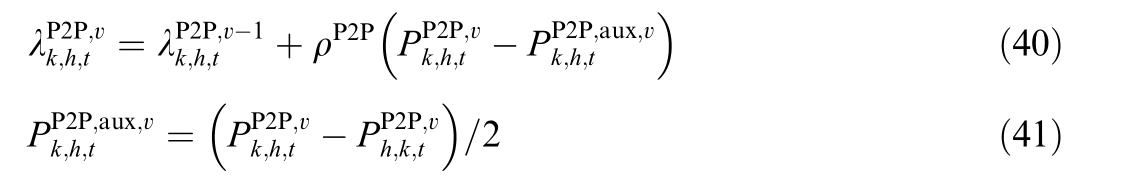

The ADMM algorithm is employed to iteratively solve the lower-level problem.First, auxiliary variables are introduced to decouple the constraints (14):

Then,the augmented Lagrangian function is established.The P2P trading problem is further decomposed into individual subproblems that can be solved independently.

s.t.(2)-(4), (6)-(13), (15)-(16), (36)-(37).where ρP2P is the positive penalty factor.When the lower-level optimal solution is obtained,the total P2P trading cost of all prosumers is zero, so the objective function of the (39) does not include the P2P trading cost.

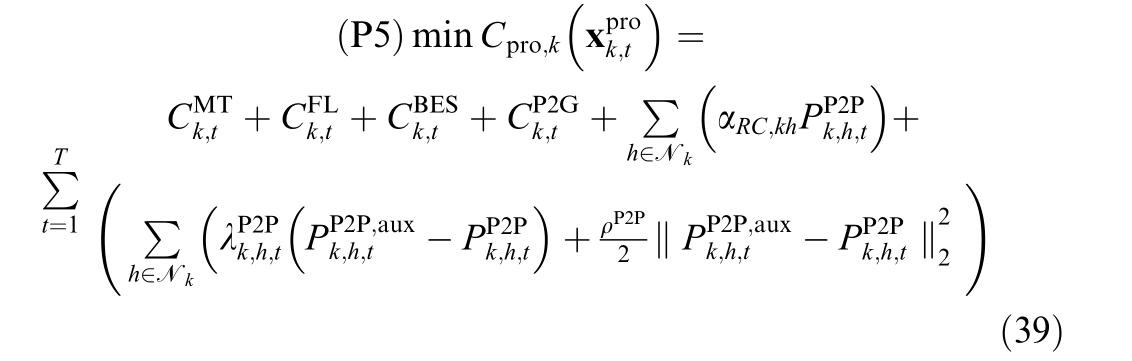

Let v represent the number of iterations for the ADMM.The update rules for the Lagrange multipliers and auxiliary variables are as follows:

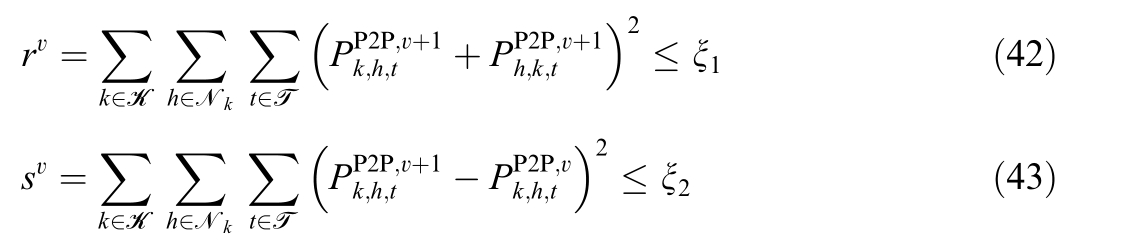

Theconvergence criteriafor the primal residual rv and dual residualsvare as follows:

where ξ1 and ξ2are the set error tolerances.

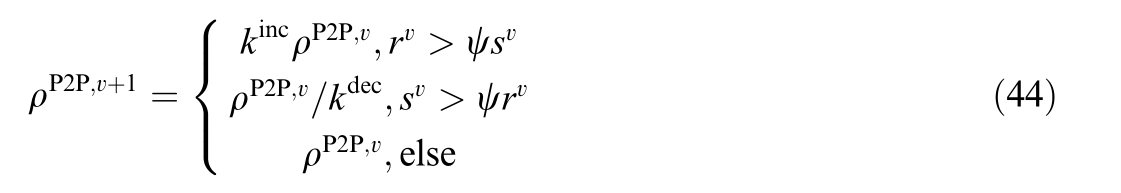

The penalty factor greatly influences the convergence performance of ADMM, and a fixed step size is highly influenced by the initial values used.Therefore, this paper adopts an adaptive updating approach for the penalty factor to accelerate the iteration convergence speed [28]:

where ψis a constant used to assess the relationship between the primal and dual residua ls;k inc an dkdec are the acceleration and deceleration factor for penalty factor.

Let z represent the number of iterations for both the upper and lower levels.After the lower-level loop converges, the DSO updates the DLMP and RC-NUC based on the OPF results.When the variables of the DSO and prosumers satisfy (45) and (46), neither party’s decision will change, and the benefits will be optimal.The risk is effectively eliminated, resulting in enhanced benefits for market participants and ensuring the network security within the market environment.The proof of the existence of dynamic balance between the DSO and prosumers can be found in Appendix A.

where ξ3 and ξ4 are the set convergence tolerances.

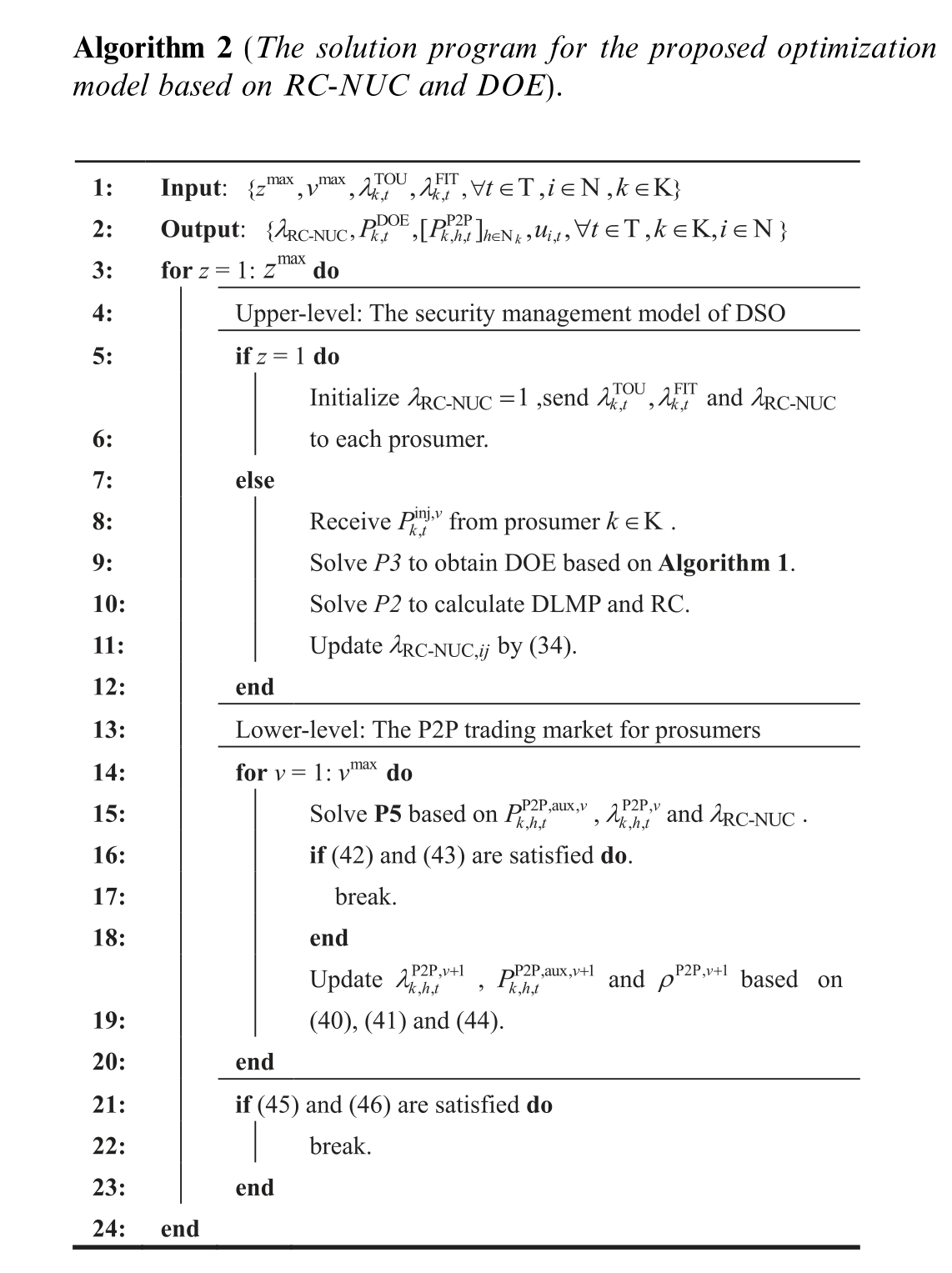

The solution program is presented in Algorithm 2.

Algorithm 2 (The solution program for the proposed optimizat model based on RC-NUC and DOE).images/BZ_174_687_2047_717_2074.pngion

2.4 Discussion on implementation challenges

Although the DOE and RC-NUC methods proposed in this paper have promising application potential, their implementation in real-world distributed energy systems still faces several challenges.Currently,DOE has been initially applied in electricity markets and pilot projects in Australia, Europe, and the United States.For example,the South Australian Power Network(SAPN)and AusNet Services in Victoria have deployed the DOE mechanism in certain areas to dynamically manage PV output and electric vehicle charging loads [19].These pilot projects have validat ed the feasibility of the DOE in distributed energy markets.However, large-scale implementation in the P2P market still depends on further advancements in measurement and communication technologies.Similarly,although the RC-NUC can improve market efficiency and network security through price incentives, its shortterm application may face challenges due to current energy policies and market regulations.Nevertheless, as the energy market gradually opens, policy reforms progress,and distributed energy trading models evolve, the prospects for implementing this method will strengthen.In particular, future markets may place greater emphasis on the role of price mechanisms in distributed energy management to improve the economic performance and safety of network operations.Against this backdrop, the RC-NUC method proposed in this paper is expected to be validated and promoted for future practical applications.

3 Case study

This section provides numerical results to validate the feasibility of the proposed method.The simulations were conducted using MATLAB 2020a.Optimization problems were modeled using the YALMIP toolbox and solved with the commercial solver GUROBI 9.1.

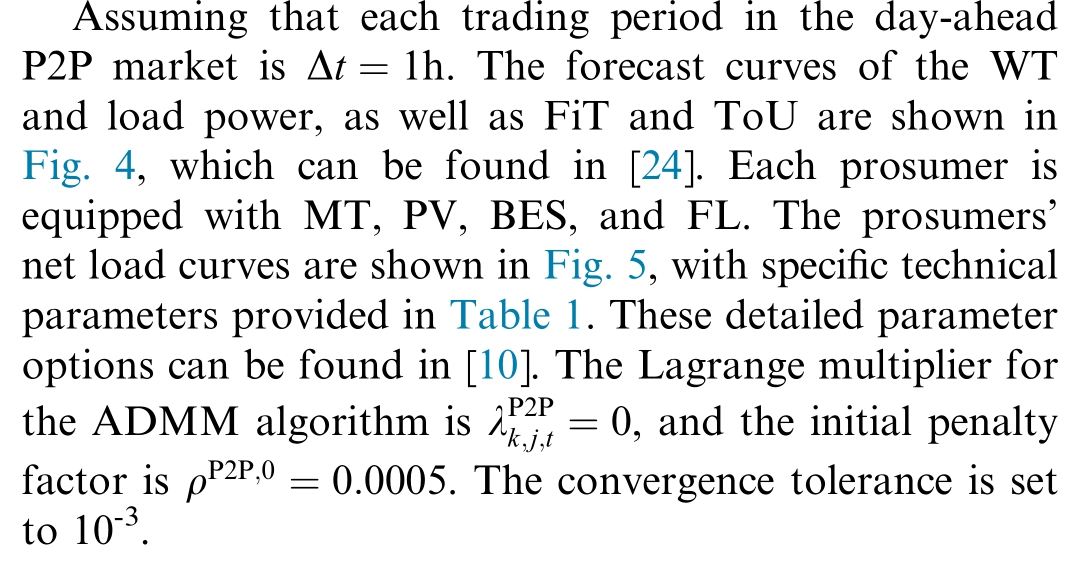

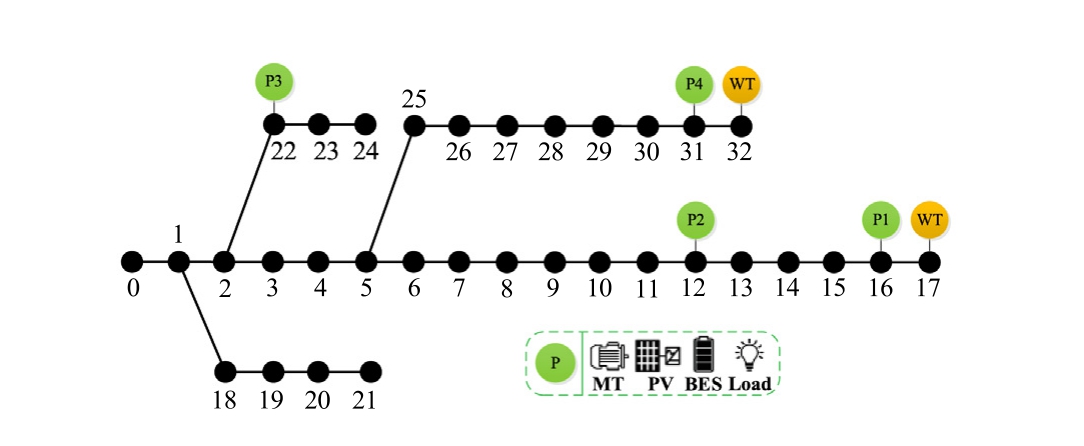

3.1 System modeling and parameter setting

A modified IEEE 33-node system is used to verify the effectiveness of the proposed method in addressing network security within a P2P trading market environment,as shown in Fig.3.The WTs with an active power capacity of 1000 kVA are installed at nodes 17 and 32.Prosumers are connected at nodes 12, 16, 22, and 31.The voltage magnitude at node 0 is set to 1 p.u.The feasible voltage range is restricted within [0.95, 1.05] p.u.

Fig.3.Topology of the modified IEEE 33-node system.

Fig.4.ToU, FiT, WT and load power output prediction curves.

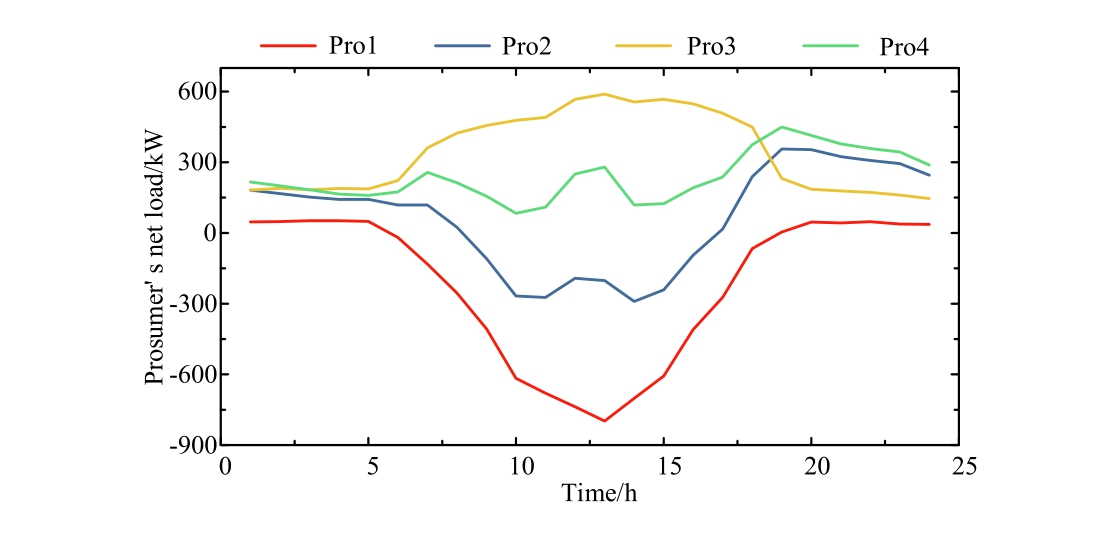

Fig.5.Prosumers’ net load curves.

Table 1 Prosumers’ technical parameters.

Parameter Value k , bMT k , cMTk 0.0012, 1.4, 0 μFL aMT k , βFLk 0.1, 0.05 CNY/(kW·h)2 dBES k 0.01 CNY/(kW·h)PMT k max 500 kW ηch k , ηdisk 0.95, 0.96

3.2 Performance analysis of the integrated RC-NUC and DOE guidance method

To validate the effectiveness of the proposed method,the following five cases are set for comparative analysis:

Case 1: Prosumers freely participate in P2P trading without considering network constraints.

Case 2: Prosumers engage in P2P trading guided solely by RC-NUC.

Case 3:Prosumers engage in P2P trading guided by RCNUC using the gradually shrinking feasible domain method.

Case 4: A bi-level optimization model incorporating DOE and NUC methods.

Case 5: A bi-level optimization model incorporating DOE and RC-NUC methods proposed in this paper.

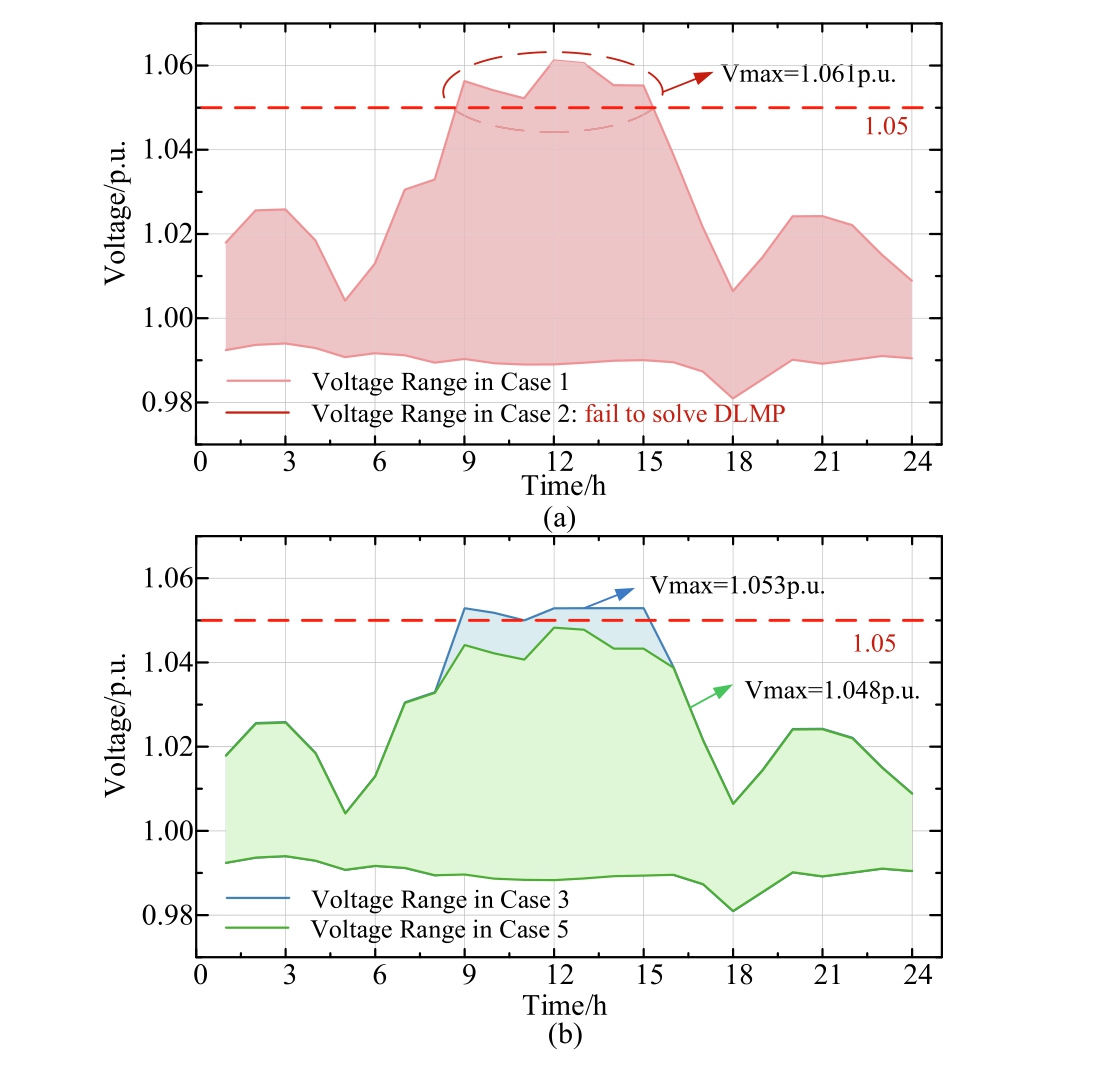

To highlight the advantages of the DOE method, we first analyze cases without DOE and compare the impact of P2P transactions on node voltages with and without RC-NUC guidance.As shown in Fig.6(a), significant overvoltage occurs during several periods in the absence of network constraints.This issue is particularly evident between 09:00 and 15:00 when PV generation increases sharply.Since prosumers aim to maximize their economic benefits, they tend to sell excess electricity to other prosumers or the main grid.This leads to voltage violations at certain nodes, especially in areas near the end of distribution lines.For example, at 12:00, the voltage at prosumer 1 reaches 1.061 p.u., significantly exceeding the safety threshold, indicating a high risk of overvoltage.Under such conditions, P2P transactions not only pose risks to network security but may also disrupt market operations.When RC-NUC is used to guide prosumer transactions, the DSO fails to compute DLMP under the current trading conditions, resulting in market clearing failure.This outcome suggests that without the DOE method, relying solely on RC-NUC may still be insuffi-cient to effectively regulate voltage levels.

Fig.6.The network voltage amplitude in different cases: (a) case 1 and case 2, (b) case 3 and case 5.

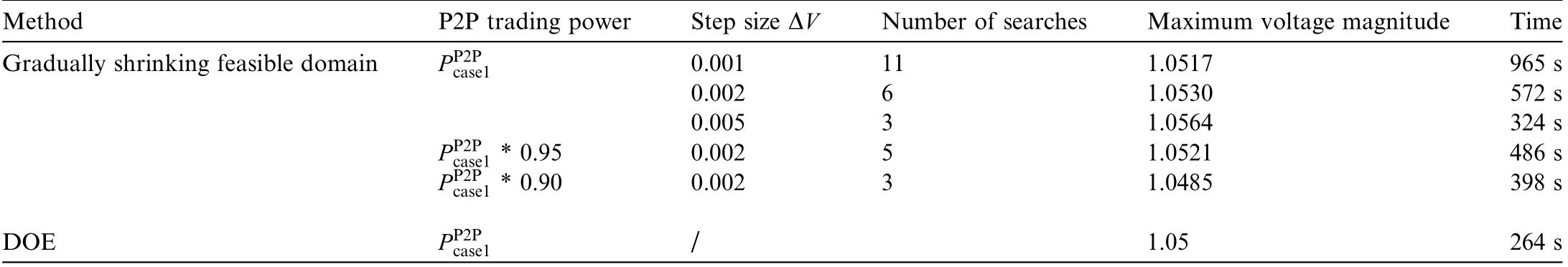

Since P2P transaction power may lead to an unsolvable OPF problem,additional methods are typically required to ensure the power flow remains solvable when adopting the RC-NUC method.Fig.6(b) illustrates voltage variations under two control strategies.Taking a step size of ΔV = 0.002 p.u.as an example, after six iterations of feasible domain search, the DLMP is determined when the upper voltage limit reaches 1.062 p.u., and the RC-NUC is calculated by the DSO to further guide prosumers.The results show that after applying this approach,voltage violations during the 09:00-15:00 period are significantly mitigated, with the maximum voltage amplitude reduced from 1.061 p.u.to 1.053 p.u.However, some nodes still exceed the safety threshold, indicating that the risk of overvoltage is not entirely eliminated.In contrast, the DOE method explicitly defines feasible region constraints,ensuring power flow solvability.Then, P2P transactions are further optimized based on price signals, encouraging high-risk nodes to maintain a certain security margin.Compared to cases without network constraints, the proposed method reduces voltage violation risks by 18.31%,significantly improving distribution network security and transaction stability.Furthermore, since DOE predefines transaction limits, it reduces the computational burden associated with iterative price adjustments, making the entire optimization process more efficient.

Table 2 compares the impact of the initial P2P trading power values and feasible domain search step sizes on the performance of RC-NUC guidance.As shown in the table,for the same step size, smaller initial P2P trading power values result in fewer search iterations and shorter time.For the same initial trading power value, larger step sizes lead to less effective guidance.Therefore, the RC-NUC is highly sensitive to the selection of initial values,and when combined with the gradually shrinking feasible domain method,the step size also influences the search time.Additionally,when the trading power is large,this method may struggle to ensure voltage safety.However,when the DOE method is employed,the voltage magnitude remains within the constraint range,and the total processing time is significantly reduced, highlighting the effectiveness and feasibility of DOE in ensuring a solvable power flow.

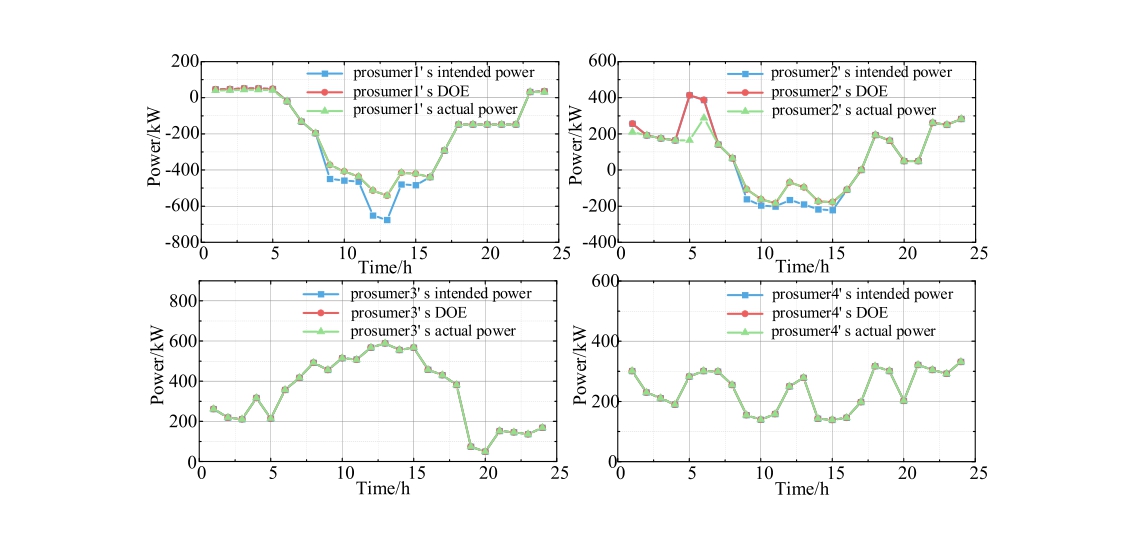

To this end, the DSO performs the DOE calculation before determining the RC-NUC.The expected import and export power,the allocated DOE,and the final import and export power for each prosumer are shown in Fig.7.Since prosumers 1 and 2 have excessive export between 09:00 and 15:00, this leads to voltage violations at the end nodes.As seen in Fig.7, the DOE of prosumers 1 and 2 has been reduced to varying degrees compared to their expected export quantities.After incorporating the DOE, the new round of P2P trading is limited within the DOE limits.

In summary, under the safe feasible region determined by DOE, prosumers adjust their scheduling strategies and trading strategies with other market participants to ensure voltage security.Therefore, combining the DOE and RC-NUC methods can effectively address the drawbacks of gradually shrinking feasible domain approach.

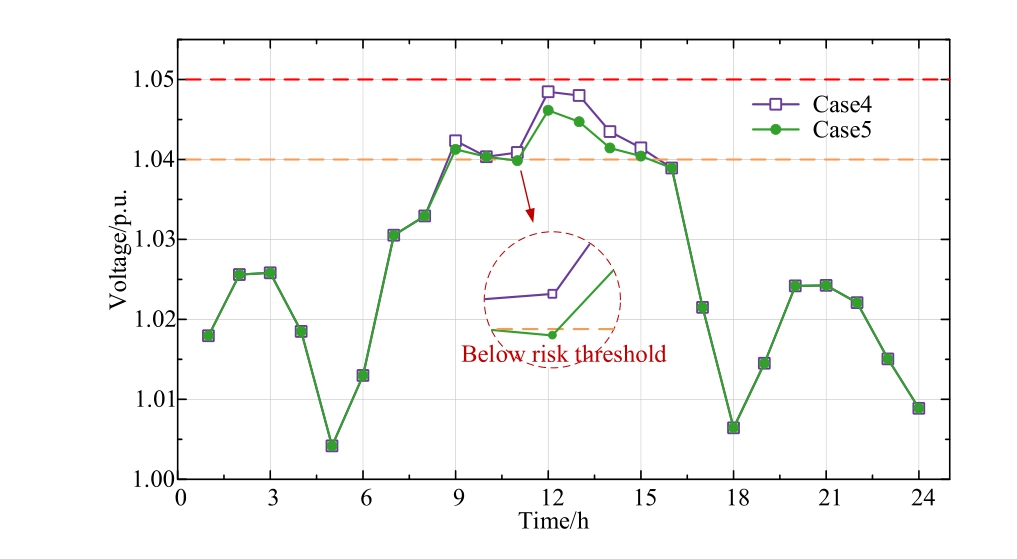

To prove the superiority of the proposed RC-NUC over the existing NUC in reducing system risks, we calculate and compare both methods under the DOE to assess their control effectiveness.Since high-risk nodes are primarily located at the end of distribution lines, node 18 is selected as a representative for voltage analysis.Fig.8 compares voltage magnitudes at node 18 under both methods.Compared with NUC, the RC-NUC shows better voltage regulation when the voltage exceeds 1.04 p.u.(such as 10:00-14:00), reducing the maximum voltage at node 18 from 1.048 p.u.to 1.045 p.u.Moreover,when the voltage amplitude is lower than 1.04 p.u.,the difference between the control effects of the two methods is small,indicating that RCNUC is particularly effective in suppressing risks as the voltage nears the violation threshold.

The reason why RC-NUC can perform more effectively during high-risk voltage periods is that this method takes into account the impact of P2P transactions on the physical structure of the network, and can more accurately reflect the impact of different transaction on the network voltage.Specifically, by increasing the transaction cost of high-risk nodes, RC-NUC guides prosumers to reduce the energy backflow to areas near voltage violation thresholds, thus effectively reducing the risk of overvoltage.In contrast, the traditional NUC is only based on general power flow constraints, which fails to fully describe the influence of P2P transactions on local voltage,so its regulation ability is weak in high-risk scenarios.The abovecomparison shows that the RC-NUC mechanism can not only reduce the probability of voltage over-limit more effectively but also provide more accurate trading guidance in key high-risk periods, thus further improving system security and operational stability.This verifies the reliability and practical value of RC-NUC in improving the security of the power system in a distributed energy environment.

Table 2 Comparison of RC-NUC guidance effects with different P2P trading power and step sizes.

Method P2P trading power Step size Δ Number of searches Maximum voltage magnitude Time Gradually shrinking feasible domain case1 0.001 11 1.0517 965 s 0.002 6 1.0530 572 s 0.005 3 1.0564 324 s case1 * 0.95 V PP2P PP2P 0.002 5 1.0521 486 s Pcase1 * 0.90 0.002 3 1.0485 398 s P2P P P2P DOE case1 / 1.05 264 s

Fig.7.Prosumers’ intended power, DOE and actual power.

Fig.8.Comparison of voltage amplitude at node 18 under different price guidance.

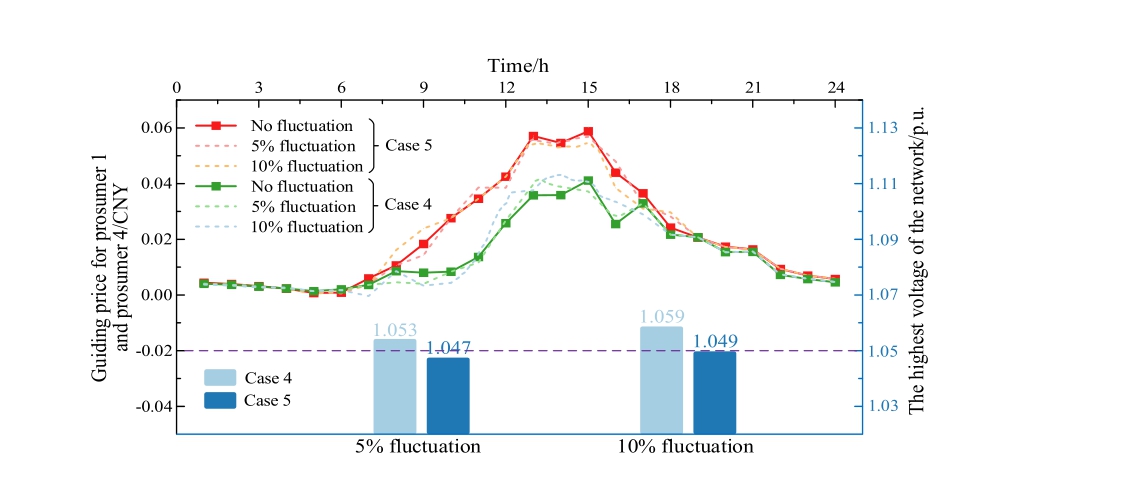

Additionally,to further evaluate the effectiveness of the proposed RC-NUC,Fig.9 compares electricity prices and voltage security of Case 4 and Case 5 under renewable energy output fluctuations.Taking the guide price between prosumer 1 and 4 as an example,in the case of PV output fluctuation of 5% and 10%, the actual calculated price(dotted line) will have a certain deviation from the price obtained without considering the fluctuation (solid line).Compared to the traditional NUC adopted in Case 4,the error of RC-NUC adopted by Case 5 is smaller in an uncertain environment due to consideration of a certain voltage margin.If fluctuations cause the node voltage to approach the boundary, a higher RC value ensures that the guide price reflects these fluctuations to mitigate risks.It can also be seen from 12:00 to 15:00 in the figure that the NUC remains low under renewable energy fluctuations,failing to effectively regulate the voltage range.In contrast,the introduction of RC enhances targeted guidance for prosumers, ensuring the method remains effective even in uncertain environments.Regardless of whether the fluctuation is 5% or 10%, Case 4 fails to effectively respond to uncertainty, leading to system limit violations.However,Case 5 successfully maintains system voltage within a safe range under both conditions, demonstrating that the RCNUC method effectively mitigates the impact of uncertainties on transactions and system security.

Fig.9.Comparison of prices and voltage safety under fluctuations in

3.3 P2P transaction results and algorithm analysis

1) Trading results of prosumers under RC-NUC guidance

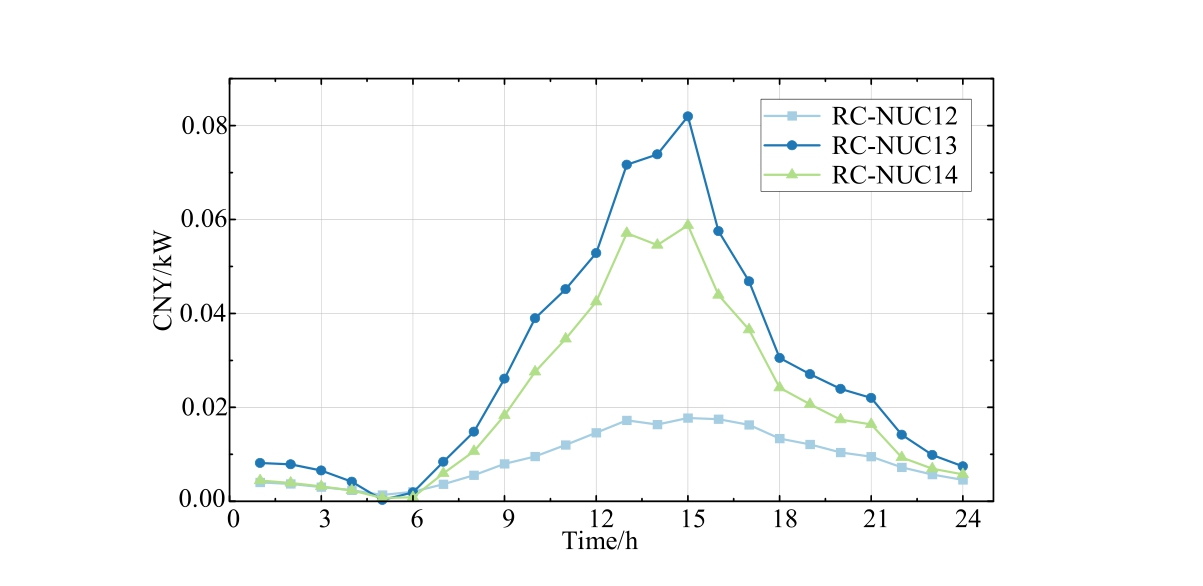

The final RC-NUC received by prosumer 1 is shown in Fig.10.During the period of 09:00-15:00,due to the high PV output, the prosumers can mobilize more power, so P2P transactions are more frequent,and RC-NUC reaches the peak.Since the trading between prosumer 1 and 2 has minimal impact on the voltage, the RC-NUC is less than 0.02CNY/kW.However, there are frequent transactions between prosumers 1 and prosumers 3 and 4, which can lead to the risk of voltage over-limit when the network is in a critical state.Therefore, the received RC-NUC is large, up to 0.082CNY/kW.After receiving the RCNUC, the prosumer needs to pay an additional risk operation cost,which incentivizes them to adjust trading quantities to mitigate risks.Overall, the unit price of risk operation costs that prosumers need to pay is relatively low, meaning that RC-NUC will not affect the economic benefits of prosumers participating in P2P transactions while guiding grid-friendly transactions.

Fig.10.Prosumer1 s RC-NUC.

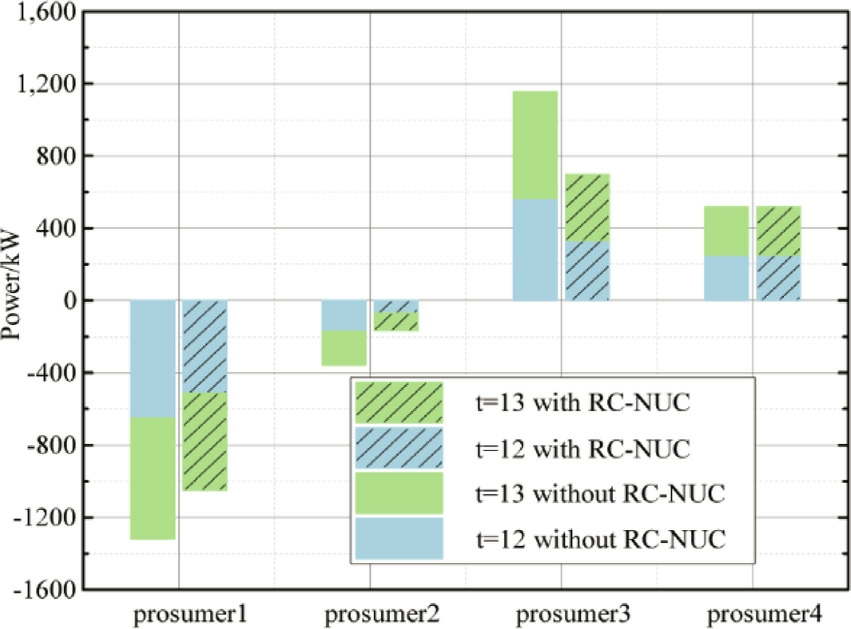

With the guidance of RU-NUC,prosumers adjust their P2P trading power in response to the price signals.Since the voltage operates near the security upper bound at t = 12 and t = 13, Fig.11 shows the total P2P trading power of each prosumer during these periods.The results indicate a general reduction in trading quantities to mitigate the risk of voltage violations.The power reductions for prosumers 1 and 2 are relatively large, indicating that their trading during these periods is more likely to cause network risks.Through RU-NUC guidance, prosumers reduce part of trading power and achieve network security while maximizing their interests.

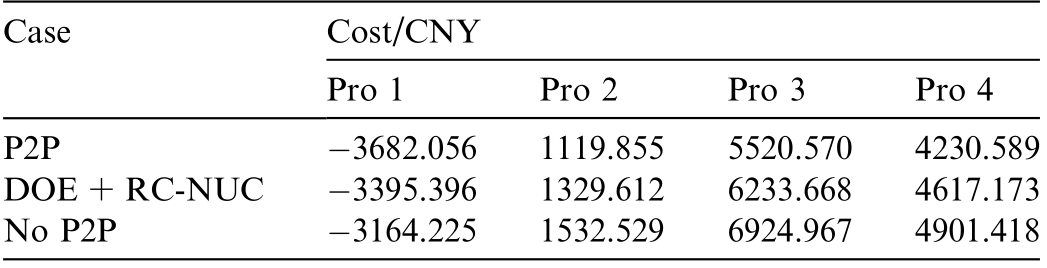

Table 3 shows a comparison of prosumers’costs across different cases.Prosumers achieve the lowest costs when they participate freely in the P2P market.This is because,in the absence of network security constraints, prosumers can maximize the utilization of internal flexible resources,facilitating optimal energy complementarity through P2P trading.Conversely,under the guidance of RC-NUC,prosumers incur additional risk costs,leading to an increase in costs.However, compared to the case where prosumers can only trade energy with the DSO, the cost advantages are still significant, providing an incentive for prosumers to continue participating in the P2P market.This highlights the effectiveness of the proposed method in balancing prosumer economic interest.

Fig.11.The total P2P trading power of different prosumers.

Table 3 Comparison of prosumers’ operating costs.

Case Cost/CNY Pro 1 Pro 2 Pro 3 Pro 4 P2P 3682.056 1119.855 5520.570 4230.589 DOE + RC-NUC 3395.396 1329.612 6233.668 4617.173 No P2P 3164.225 1532.529 6924.967 4901.418

2) Performance analysis of the distributed algorithm

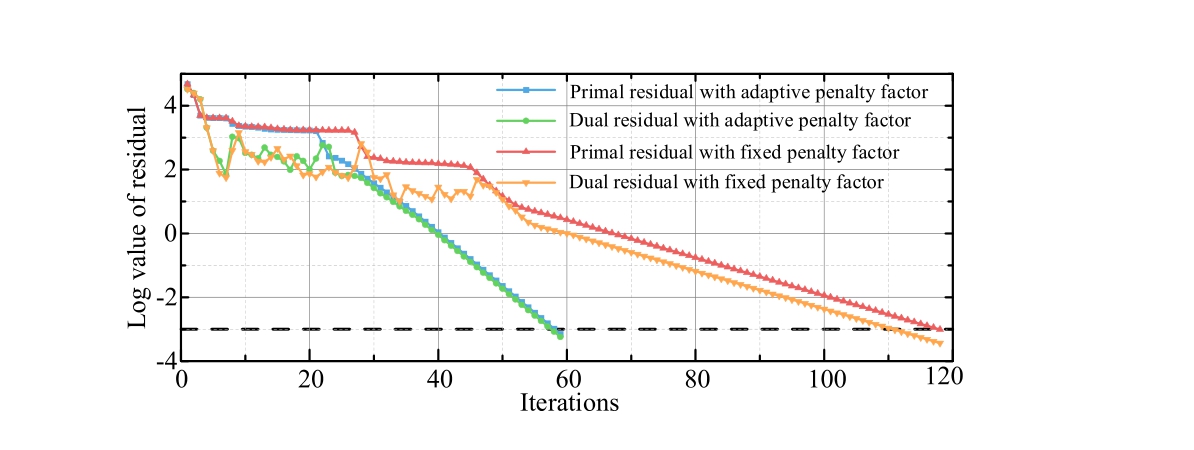

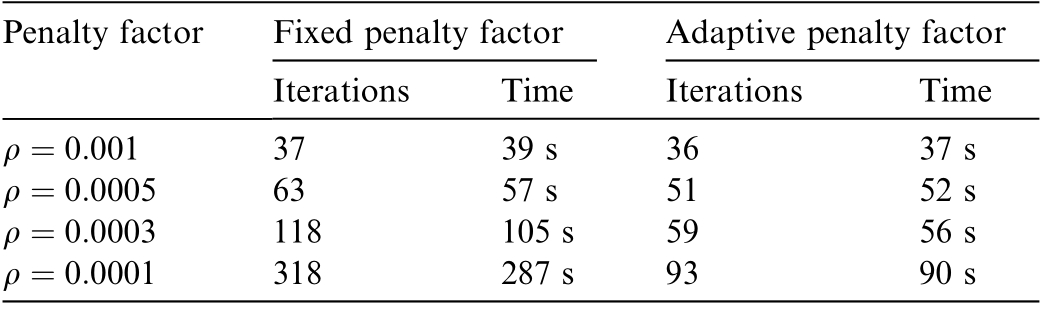

This paper adopts an adaptive penalty factor selection method to improve the efficiency of solving P2P trading problem.The convergence performance of the primal and dual residuals under fixed and adaptive penalty factor were compared in Fig.12.The results show that when the primal residual is significantly larger or smaller than the dual residual, the improved ADMM dynamically adjusts the step size, effectively reducing the number of iterations and enhancing overall convergence efficiency.In the test case, the proposed algorithm reduces the average number of iterations from 118 to 59, significantly accelerating the computation process.

Table 4 further evaluates the convergence performance of the ADMM-based distributed algorithm using fixed and adaptive penalty factors under different step sizes.The results show that the traditional ADMM is highly sensitive to the choice of initial step size.When the step size is small,the convergence speed of the algorithm is slow and the number of iterations increases greatly.When the step size is large, it may lead to oscillation or divergence, which affects the convergence stability.In contrast, the ADMM with an adaptive penalty factor accelerates the stabilization of the optimization process by dynamically adjusting the step size, thereby reducing dependence on the initial step size.Across all tested step sizes, the solution time of proposed algorithm is shortened by 32.3% on average,showing better convergence efficiency and robustness,which is suitable for large-scale P2P transaction optimization problems.

Fig.12.The primal and dual residual of fixed and adaptive penalty factor.

Table 4 Comparison of solving speeds under different step sizes.

Penalty factor Fixed penalty factor Adaptive penalty factor rations Time Iterations Time s 37 s Ite ρ 001 37 39 36 ρ 0 0 0005 63 57 s 51 52 s ρ 0 0003 5 s 56 s ρ 0 0001 7 s 90 s 118 10 59 318 28 93

4 Conclusion

This paper proposes a novel bi-level framework based on DOE and RC-NUC for DSO-prosumers coordination scheduling in P2P trading market.The upper-level uses DOE and RC-NUC to guide prosumers in adjusting their trading strategies and ensure the network security.The lower-level constructs a decentralized P2P market that exchanges only price and power information to protect privacy.The framework was tested on an improved IEEE 33-node distribution network,and the results show the following: (1)RC-NUC fully accounts for the impact of P2P transactions on network power flow.Compared to traditional NUC, it more accurately guides prosumers in adjusting their trading, reducing the voltage violation risk by 18.31%.(2) The integrated DOE dynamically adjusts optimal import/export power, allowing prosumers to freely determine P2P trading power and price within a feasible domain while ensuring that upper-level OPF calculations remain solvable.(3) The ADMM with adaptive penalty factor enhances computational convergence,reducing the average solution time by 32.3%, while maintaining trading independence and privacy.

This study assumes that DOE is calculated in a deterministic environment.Future research will focus on developing robust DOE calculation to better address the risks posed by fluctuations in renewable energy generation and P2P transactions on network operation.Furthermore,as the scale of the P2P market expands, the complexity of DOE and RC-NUC calculations will increase significantly.We will explore more efficient distributed algorithms for communication to reduce overhead,enhance system coordination,and further improve the practicality of the methods proposed in this paper.

CRediT authorship contribution statement

Lei Dong: Supervision, Writing - review & editing.Kuang Zhang: Visualization, Conceptualization, Writing- original draft, Methodology. Shiming Zhang: Supervision, Validation. Tao Zhang: Supervision, Validation. Ye Li: Supervision. Ji Qiao: Supervision.

Declaration of competing interest

The authors declare the following financial interests/personal relationships which may be considered as potential competing interests: Ye Li and Ji Qiao are currently employed by China Electric Power Research Institute.

Acknowledgments

This wor k was fina ncia lly fu nde d by the National Natural Sci en c e Foun dati on of Ch ina (Gra nt/Award Numbers: 52277098).Appendix A

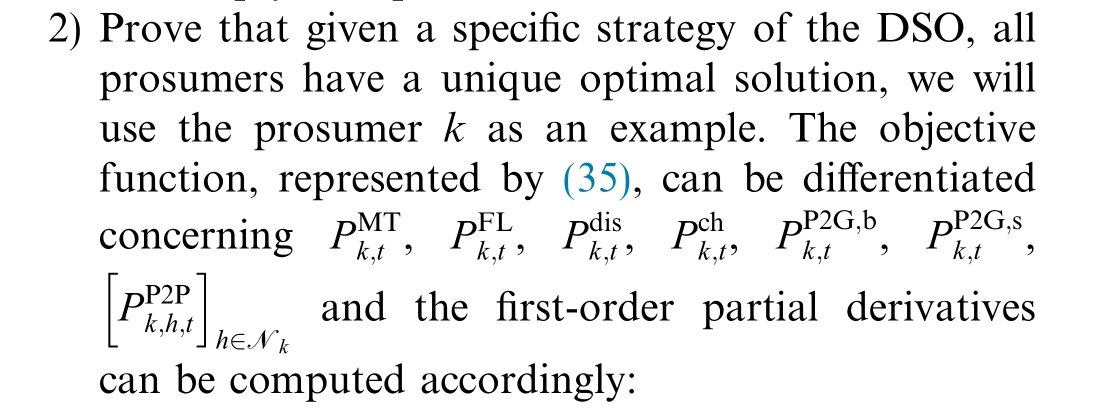

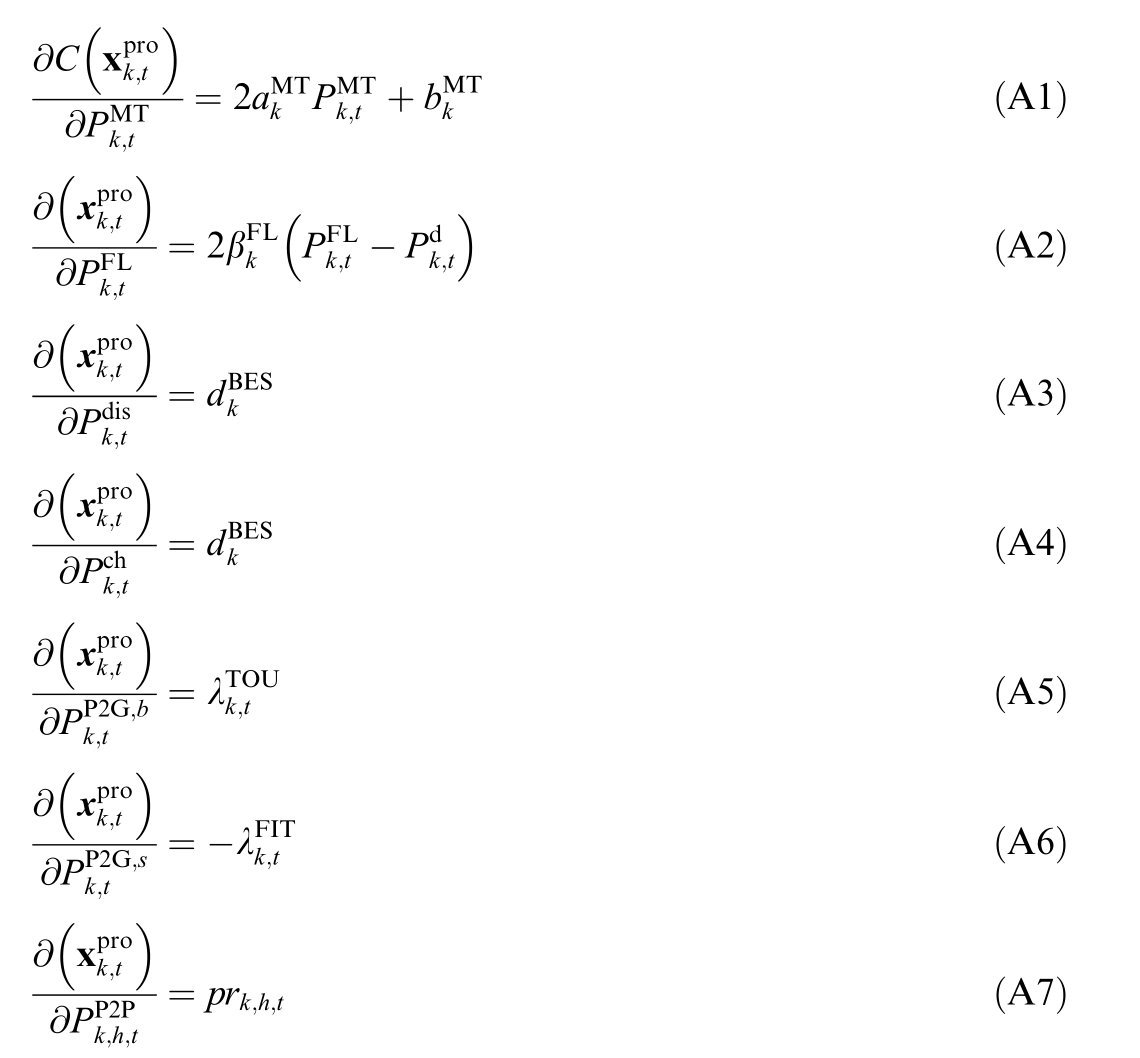

A unique dynamic equilibrium exists between the DSO and prosumers when the following conditions are met:

1) The strategy sets of both the DSO and prosumers are non-empty, compact, and convex.

2) For any given strategy of the DSO, each prosumer has a unique optimal solution.

3) For each prosumer’s strategy,the DSO has a unique optimal solution.

Proof

1) Based on the model established in this paper, it can be inferred that the strategies of DSO must satisfy(18)-(26).Similarly,the strategies of prosumers must satisfy (7)-(13), (15)-(16), and (36)-(37).Therefore,it follows that the strategy sets of both the DSO and the prosumers exhibit the properties of being non-empty, compact, and convex.

For![]() ,its first derivatives are constant, indicating that it is a linear function in the objective function.Therefore,for any DSO strategy,the prosumer k will have a unique response value.

,its first derivatives are constant, indicating that it is a linear function in the objective function.Therefore,for any DSO strategy,the prosumer k will have a unique response value.

Let the first-order partial derivatives of ![]() and

and![]() be equal to 0, we have:

be equal to 0, we have:

Next, taking the second-order partial derivatives for![]() and

and![]() respectively.We have:

respectively.We have:

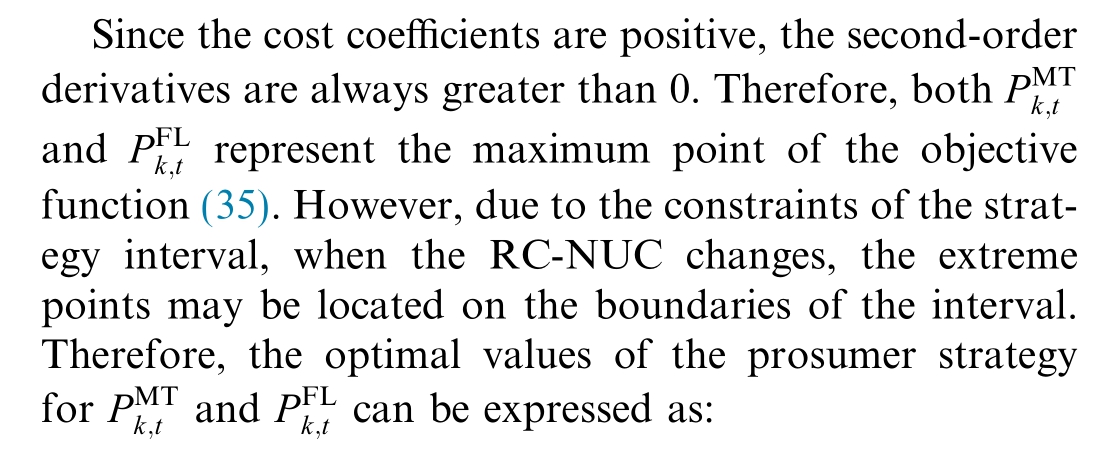

In summary, regardless of the specific values, when the DSO’s RC-NUC is given, there is exactly one optimal solution for the prosumers corresponding to that strategy.

3) When the strategies of the prosumers are specified,the DSO has a unique optimal solution.The DSO’s objective typically involves maximizing economic profits or minimizing operational costs,with decision variables including DER output power, node voltages, and branch flows, which together form a typical non-convex nonlinear programming problem.This paper employs second-order cone relaxation techniques to transform it into a second-order cone programming model.Ref.[29] indicates that this transformation method is effective in solving OPF problems and ensures the uniqueness of the solution.By utilizing solvers such as Gurobi, Mosek, and CPLEX,a globally optimal solution can be obtained.Since the DLMP is derived from the OPF results and there is a one-to-one correspondence between the DLMP and the OPF solutions, the DSO’s optimal strategy remains unique when the prosumers’ strategies are given.

References

-

[1]

Z.Wang, X.Yu, Y.Mu, et al., A distributed peer-to-peer energy transaction method for diversified prosumers in urban community microgrid system, Appl.Energy 260 (2020) 114327. [百度学术]

-

[2]

T.Zhang, X.Yu, Y.Mu, et al., Multiple sources restoration for soft open points in distribution networks with a two-stage accelerated algorithm, IEEE Trans.Sustain.Energy 14 (2) (2022)892-905. [百度学术]

-

[3]

Z.Wang, L.Dong, S.Zhang, et al., Market power modeling and restrain t of aggregated prosumers in peer-to-peer energy trading:a game-theoretic approach, Appl.Energy 348 (2023) 121550. [百度学术]

-

[4]

T.Jiang, T.Hua, H.Xiao, et al., P2P transaction method for distributed energy prosumers based on reputation value, Global Energy Interconnect.6 (3) (2023) 308-323. [百度学术]

-

[5]

Y.Chen, W.Pei, H.Xiao, et al., Incentive-compatible and budget balanced AGV mechanism for peer-to-peer energy trading in smart grids, Global Energy Interconnect.6 (1) (2023) 26-35. [百度学术]

-

[6]

C.Feng, B.Liang, Z.Li, et al., Peer-to-peer energy trading under network constraints based on generalized fast dual ascent, IEEE Trans.Smart Grid 14 (2) (2022) 1441-1453 [百度学术]

-

[7]

M.Yan,M.Shahidehpour,A.Paaso,et al.,Distribution networkconstrained optimization of peer-to-peer transactive energy trading among multi-microgrids, IEEE Trans.Smart Grid 12 (2) (2 )1 -1047. [百度学术]

-

[8]

H.Hou, Z.Wang, B.Zhao, et al., Peer-to-peer energy trading among multiple microgrids considering risks over uncertainty and distribution network reconfiguration: a fully distributed optimization method, Int.J.Electr.Power Energy Syst.153(2023) 109316. [百度学术]

-

[9]

C..Long, L..F..Ochoa, Voltage control of PV-rich LV networks:OLTC-fitted transformer and capacitor banks,IEEE Trans.Power Syst.31 (5) (2015) 4016-4025. [百度学术]

-

[10]

Y.Liu, C.Sun, A.Paudel, et al., Fully decentralized P2P energy trading in active distribution networks with voltage regulation,IEEE Trans.Smart Grid 14 (2) (2022) 1466-1481 [百度学术]

-

[11]

Y.Zou,Y.Xu,J.Li,Aggregator-network coordinated peer-to-peer multi-energy trading via adaptive robust stochastic optimization,IEEE Trans.Power Syst.(2024). [百度学术]

-

[12]

K.Zhang,S.Troitzsch,S.Hanif,et al.,Coordinated market design for peer-to-peer energy trade and ancillary services in distribution grids, IEEE Trans.Smart Grid 11 (4) (2020) 2929-2941. [百度学术]

-

[13]

H.Ruan, H.Gao, H.B.Gooi, et al., Active distribution network operation management integrated with P2P trading, Appl.Energy 323 (2022) 119632. [百度学术]

-

[14]

H.Yao, Y.Xiang, J.Liu, Virtual prosumers’ P2P transaction based distribution network expansion planning, IEEE Trans.Power Syst.39 (1) (2023) 1044-1057. [百度学术]

-

[15]

D.F.Botelho, L.W.de Oliveira, B.H.Dias, et al., Integrated prosumers-DSO approach applied in peer-to-peer energy and reserve tradings considering network constraints,Appl.Energy 317(2022) 119125. [百度学术]

-

[16]

T.R.Ricciardi, K.Petrou, J.F.Franco, et al., Defining customer export limits in PV-rich low voltage networks,IEEE Trans.Power Syst.34 (1) (2018) 87-97. [百度学术]

-

[17]

J.Bridge,Export Limits for Embedded Generators up to 200 kVA Connected at Low Voltage, AusNet Services, Melbourne,Australia, 2017. [百度学术]

-

[18]

M.Z.Liu, L.N.Ochoa, S.Riaz, et al., Grid and market services from the edge:using operating envelopes to unlock network-aware bottom-up flexibility, IEEE Power Energ.Mag.19 (4) (2021) 52-62. [百度学术]

-

[19]

L.Blackhall, On the Calculation and Use of Dynamic Operating Envelopes, Australian National Univerity, Canberra, ACT, 2020. [百度学术]

-

[20]

K.Petrou, A.T.Procopiou, L.Gutierrez-Lagos, et al., Ensuring distribution network integrity using dynamic operating limits for prosumers, IEEE Trans.Smart Grid 12 (5) (2021) 3877-3888. [百度学术]

-

[21]

Y.Z.Gerdroodbari, M.Khorasany, R.Razzaghi, Dynamic PQ operating envelopes for prosumers in distribution networks, Appl.Energy 325 (2022) 119757. [百度学术]

-

[22]

Z.Li, Y.Xu, Temporally-coordinated optimal operation of a multi-energy microgrid under diverse uncertainties, Appl.Energy 240 (2019) 719-729. [百度学术]

-

[23]

B.Zhang, Q.Li, L.Wang, et al., Robust optimization for energy transactions in multi-microgrids under uncertainty, Appl.Energy 217 (2018) 346-360. [百度学术]

-

[24]

L.Dong, S.Zhang, T.Zhang, et al., DSO-prosumers dual-layer game optimization based on risk price guidance in a P2P energy market environment, Appl.Energy 361 (2024) 122893. [百度学术]

-

[25]

M.Farivar, S.H.Low, Branch flow model: relaxations and convexification—Part I, IEEE Trans.Power Syst.8 (3) (2013)2554-2564. [百度学术]

-

[26]

T.Ding,R.Lu,Y.Yang,et al.,A condition of equivalence between bus injection and branch flow models in radial networks, IEEE Trans.Circuits Syst.Express Briefs 67 (3) (2019) 536-540. [百度学术]

-

[27]

A.Papavasiliou, Analysis of distribution locational marginal prices, IEEE Trans.Smart Grid 9 (5) (2017) 4872-4882. [百度学术]

-

[28]

L.Wang, Q.Zhou, Z.Xiong, et al., Security constrained decentralized peer-to-peer transactive energy trading in distribution systems, CSEE J.Power Energy Syst 8 (1) (2021)188-197. [百度学术]

-

[29]

Y.Wu,J.Shi,G.J.Lim,et al.,Optimal management of transactive distribution electricity markets with co-optimized bidirectional energy and ancillary service exchanges,IEEE Trans.Smart Grid 11(6) (2020) 4650-4661. [百度学术]

Fund Information